An Independent Contractor Agreement, also known as a consulting agreement or freelance contract Describes the services being provided or project to be completed Outlines payment details and the length, or term of the contract Sets out other terms of the working relationship, such as ownership of intellectual property1099 employees are selfemployed independent contractors They receive pay in accord with the terms of their contract and get a 1099 form to report income on their tax returnThe employer withholds income taxes from the employee's paycheck and has a significant degree of control over the employee's work• Issue Form 1099 MISC or W2 to workers you hire or employ As a booth renter, or independent contractor, you may need to make estimated tax payments during the year to cover your tax liabilities This is because as a booth renter (independent contractor), the business does not withhold taxes from your pay Estimated tax is the method used to

How To Insert Smartfields Into Your Contracts Signature Electronique

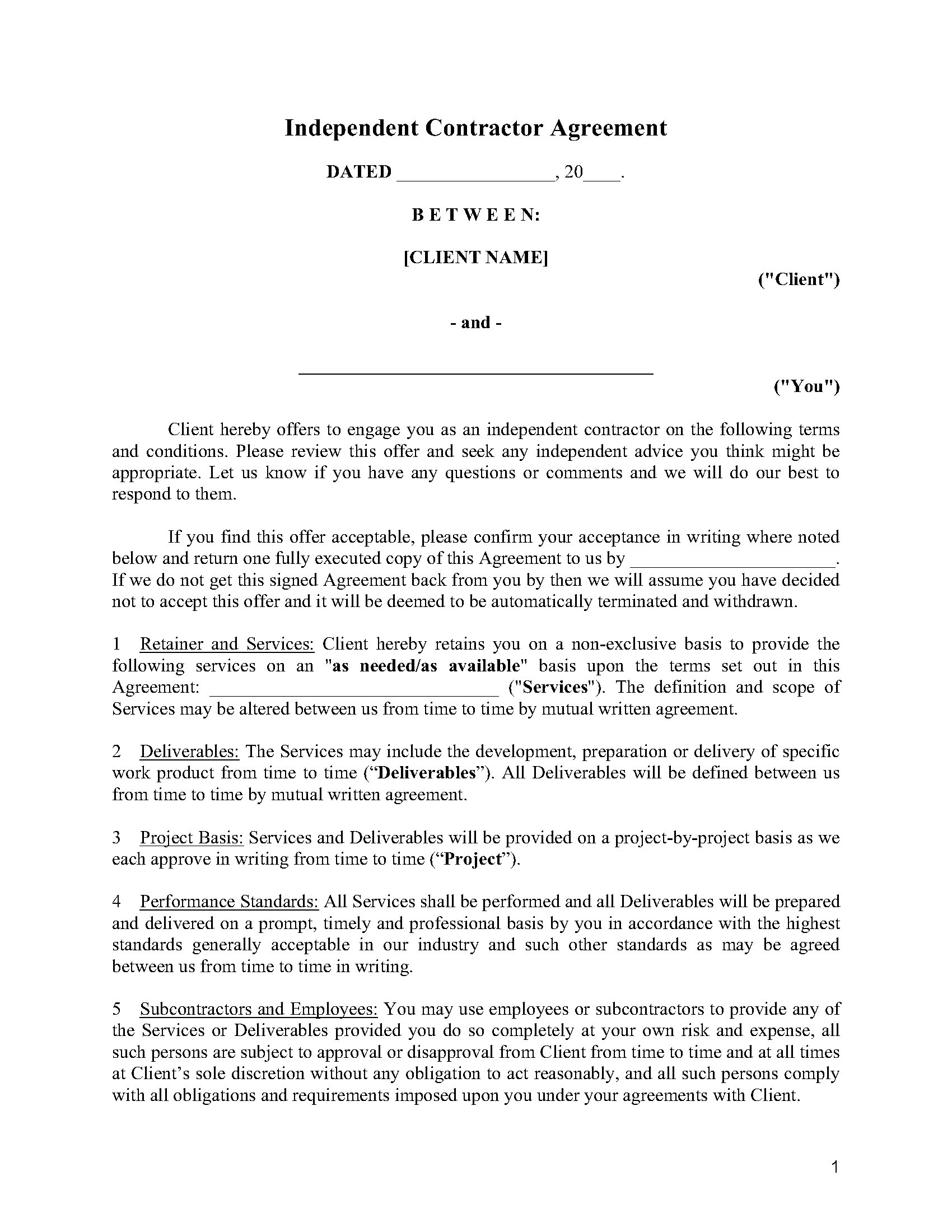

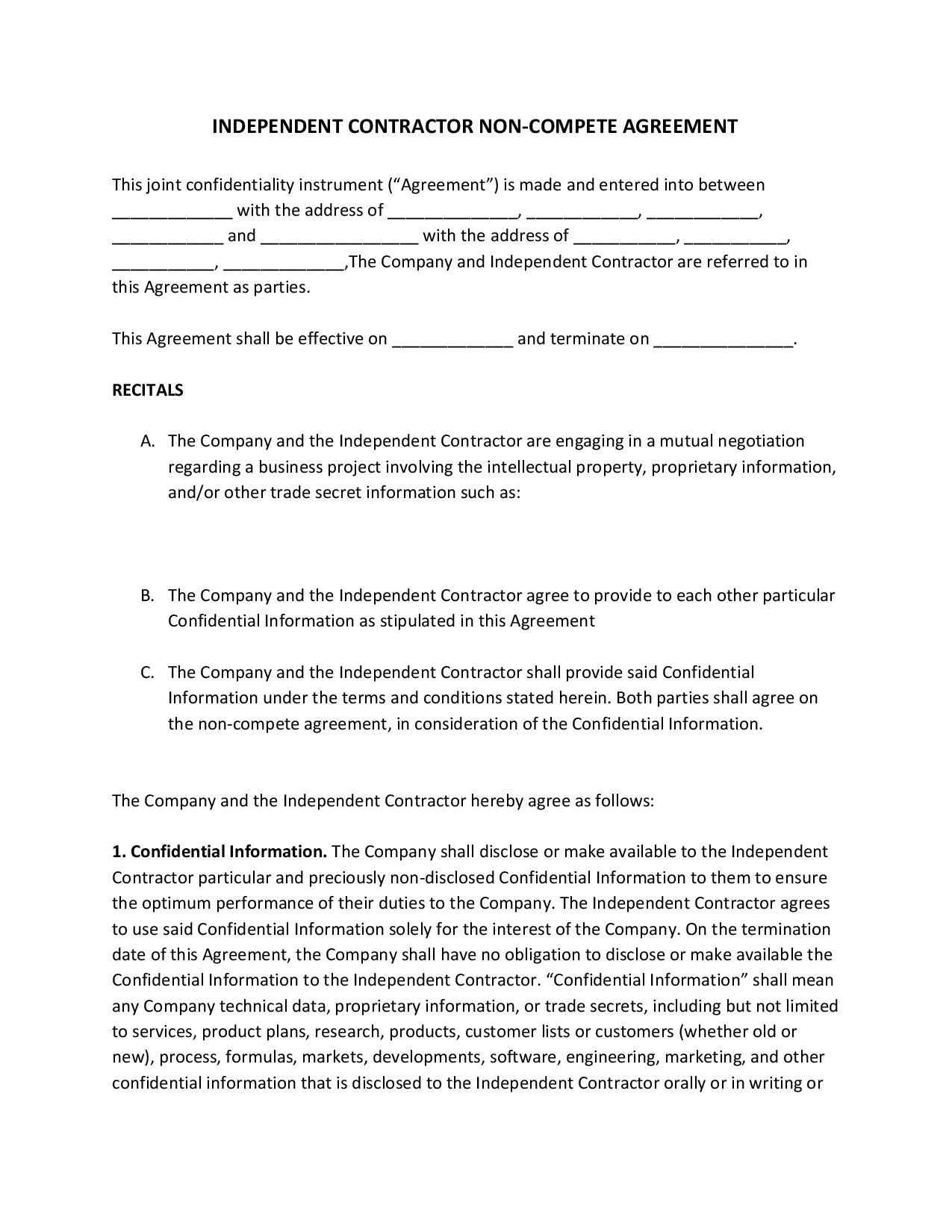

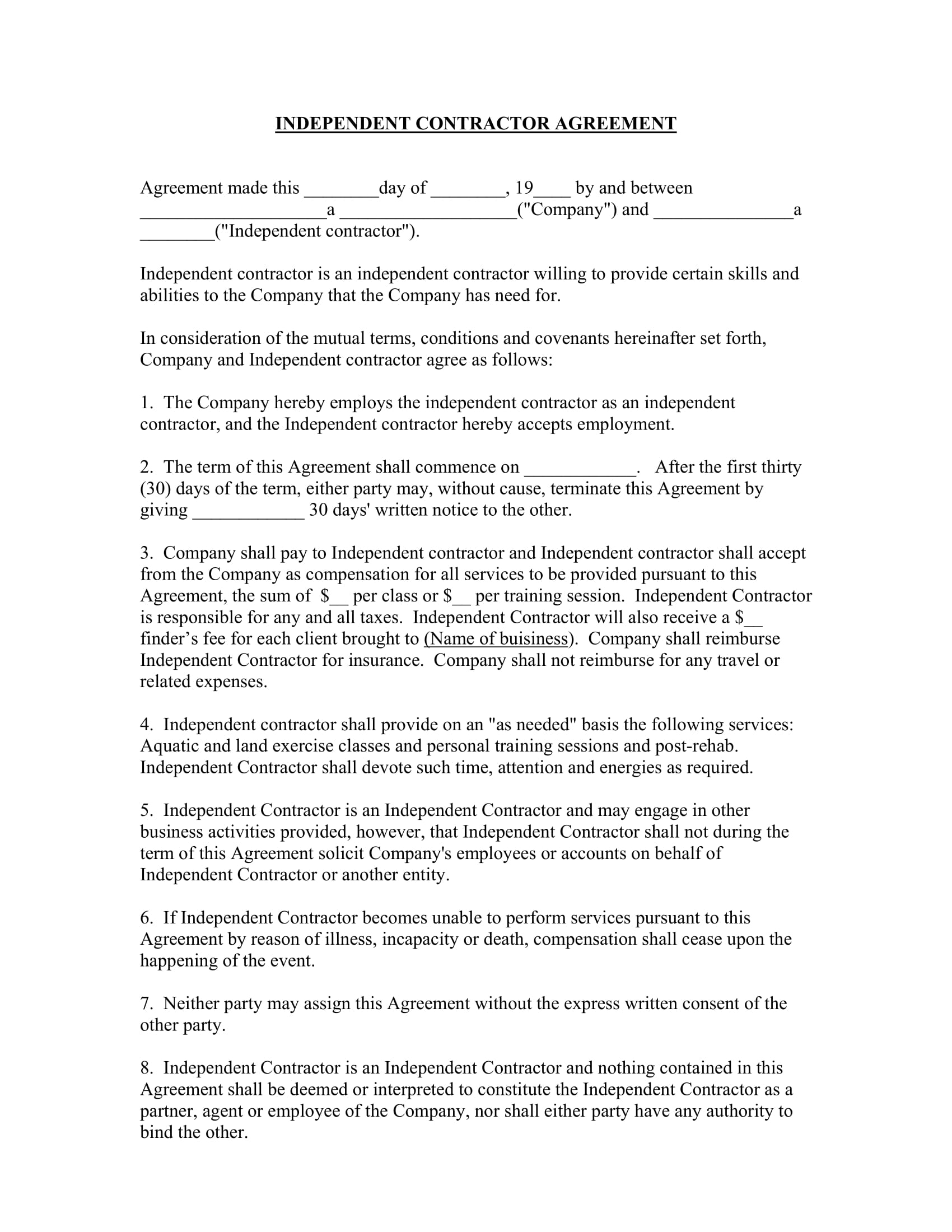

Sample independent contractor agreement

Sample independent contractor agreement-This Agreement also may be terminated at any time upon the mutual written agreement of the Company and Contractor 42 Death In the event Contractor dies during the term of this Agreement, this Agreement shall terminate, and the Company shall pay to Contractor's estate the salary which would otherwise be payable to Contractor(b) Contractor will not violate the terms of any agreement with any third party;

Free Independent Contractor Agreement Template Download Wise

Contractor represents and warrants to Company that (a) Contractor has full power and authority to enter into this Agreement including all rights necessary to make the foregoing assignments to Company;Sample Contractor Safety Agreement Form ehswfuedu Details File Format PDF;Fulton Avenue HealthCare 72 Fulton Avenue, Suite 300 Hempstead, NY Phone Nurse Practitioner Independent Contractor Agreement

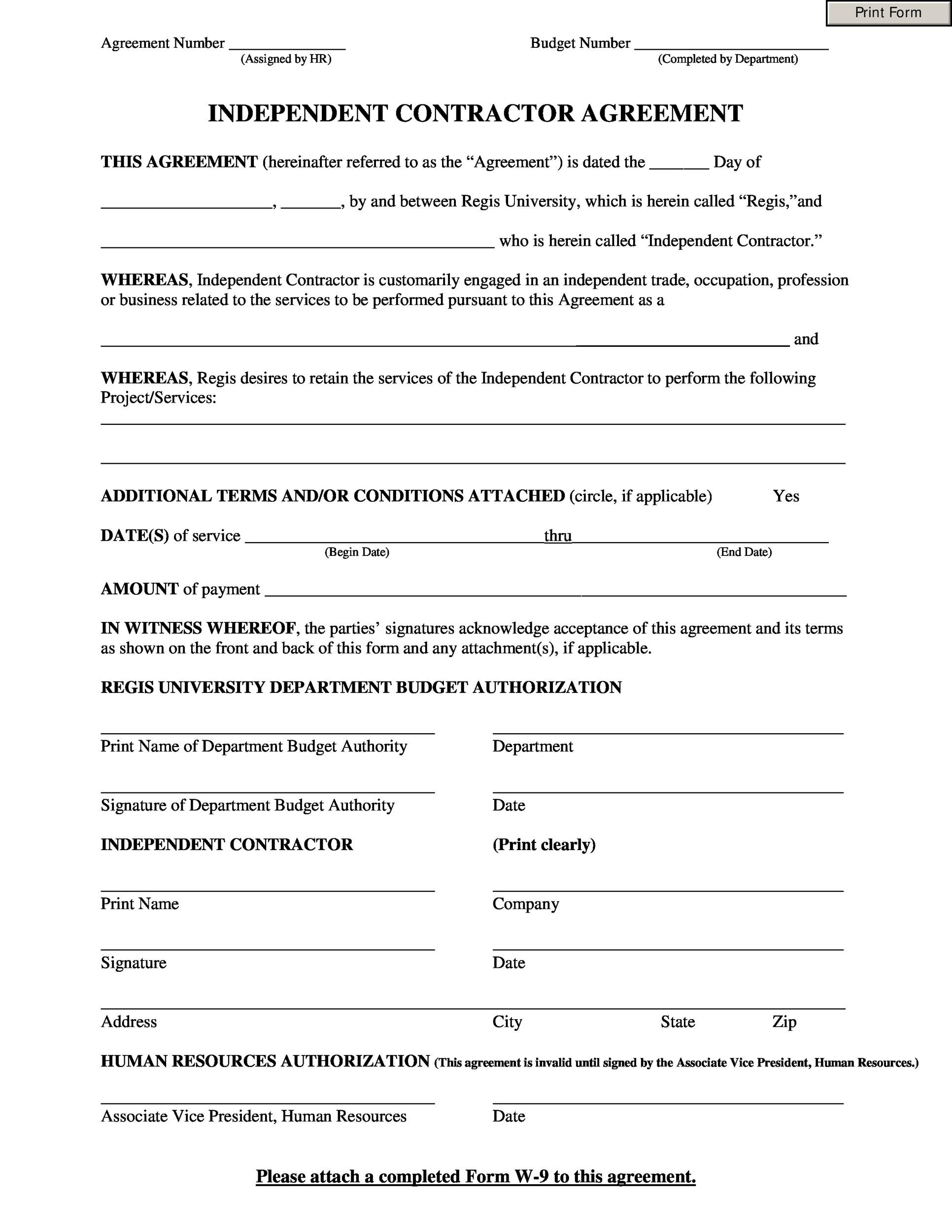

1099 CONTRACTOR AGREEMENT 1099 CONTRACTOR AGREEMENT AGREEMENT made as of _________________, between Eastmark Consulting, Inc, a MassachusettsCorporation with its principal office at 44 School Street, Boston, MA ("Eastmark"), and_________________("Contractor"), Federal Identification (or Social Security) ___________________A truck driver independent contractor agreement is a document that legally binds a contractor and their client to a working arrangement Generally speaking, truck drivers are hired to transport goods from one facility to another or from a seller to a buyer A clear description of the tasks that the contractor is required to fulfill must be provided in the work agreement Furthermore, the You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

An independent contractor agreement is a contract that documents the terms of a client's arrangement with a contractor This is also referred to as a freelance contract, a general contractor agreement, a subcontractor agreement, and a consulting services agreement, among other alternative names Updated A 1099 sales rep agreement is important to have for companies that employ sales representatives It can be the difference between staying open and being forced to shut down the company Employees who only get commissions are called 1099ers due to the 1099MISC form that they receive every yearINDEPENDENT CONTRACTOR AGREEMENT NoticesAll notices hereunder shall be in writing and shall be sent by registered mail or certified mail, return receipt requested, postage prepaid and with receipt acknowledged, or by hand (to an officer if the party to be served is a corporation), or by facsimile or by email, all charges prepaid, at the respective addresses set forth below

Non Compete Agreement Example Company Form Pdf Format Database Org Texas

Canada Independent Contractor Agreement Template Legal Forms And Business Templates Megadox Com

IRS 1099 Employee, Independent Contractor Agreement, Free Download There is NO such thing as an IRS 1099 EMPLOYEE Never use words like employee, salary, wage or payroll without withholding tax To save taxes, overtime and benefits use a FREE DOWNLOAD of the proven BlockTax INDEPENDENT CONTRACTOR AGREEMENT PRThis independent contractor agreement is between ("the Company"), an individual a(n) and ("the Contractor"), an individual a(n) The Company is in the business of and wants to engage the Contractor to The Contractor has performed the same or similar activities for others The parties therefore agree as follows 1 ENGAGEMENT;As well as your own health benefits, medical expenses, life insurance, and retirement fund CONTRACTOR also acknowledges that CONTRACTOR

Independent Contractor Agreement For Programming Services Template By Business In A Box

Independent Contractor Agreement Agreement For Consulting Services

An independent contractor agreement is a contract between a nonemployee worker and an employer for work on an outsourced job or project Independent contractor agreements are also called 1099 agreements, freelance contracts, or subcontractor agreementsIndependent Contractor shall devote such time, attention and energies as required 5 Independent Contractor is an Independent Contractor and may engage in other business activities provided, however, that Independent Contractor shall not during the term of this Agreement solicit Company's employees or accounts on behalf ofIndependent Contractor with a tax Form 1099 at the end of each year documenting the amount paid to Independent Contractor The Company will not withhold any taxes, FICA, or other amounts from its payments to Independent Contractor 9

免费official Independent Contractor Resignation Letter 样本文件在allbusinesstemplates Com

Hair Salon Barbershop Independent Contractor Agreement Breach Of Contract Damages

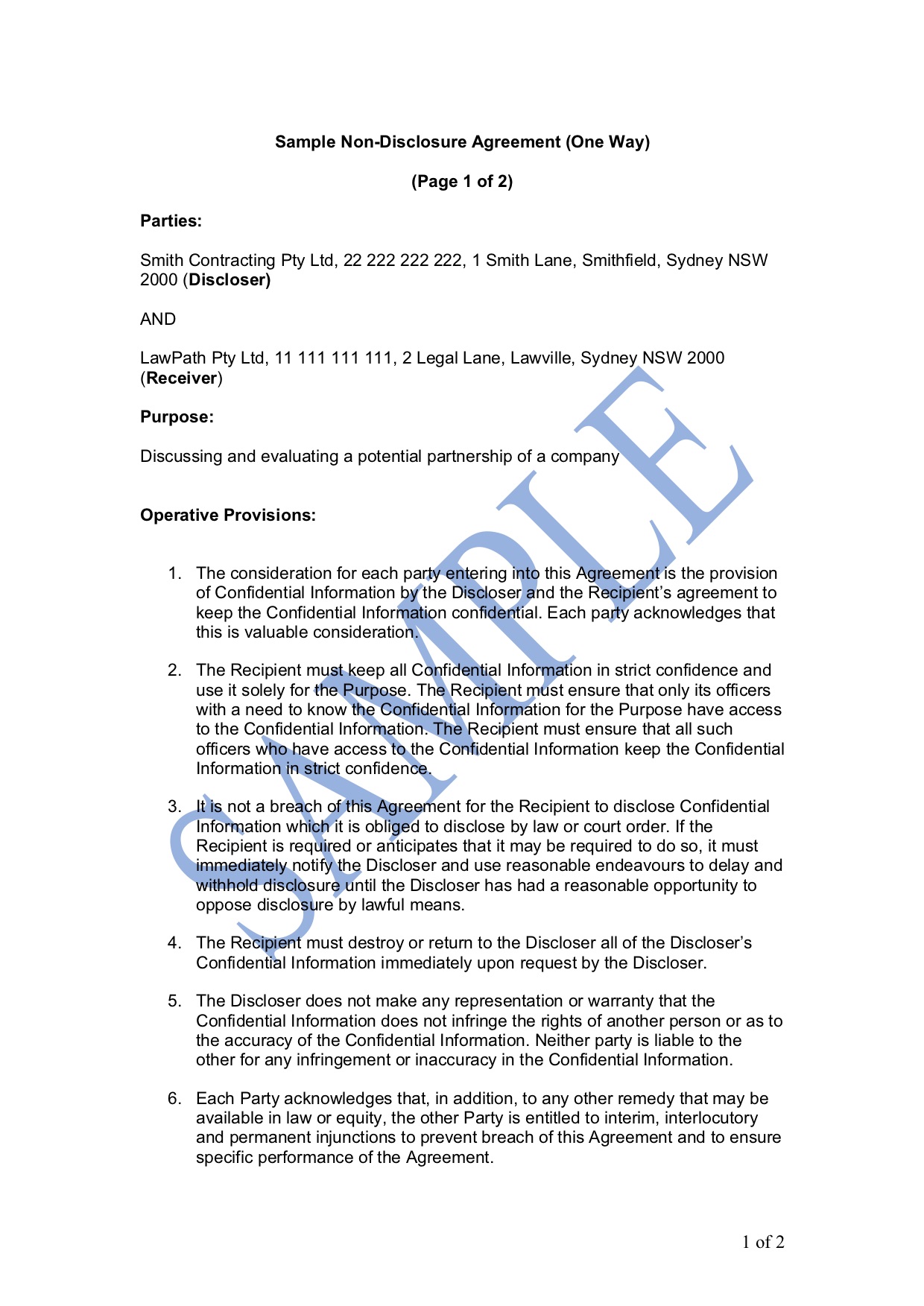

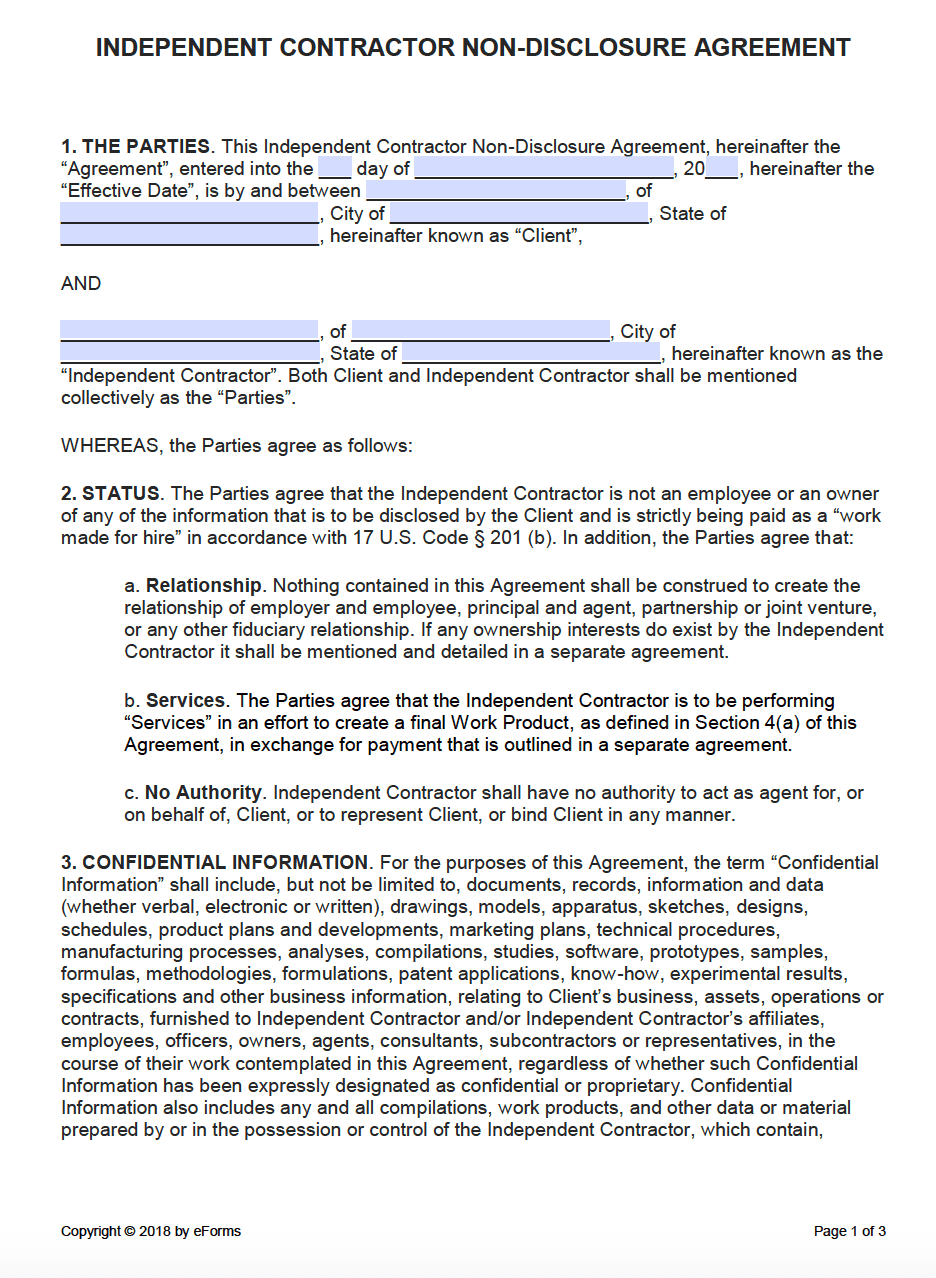

Popular Form 1099R Versions & Alternatives Form 1099A Online 1099A is a tax document that reports the annual gross proceeds from a business or from a sale of a property 1099A is used for both business and other income For example, if a person rents out a property, they may be required to submit a 1099A for that incomeFor foreign currency contracts g I didn't sign a contract with my employer The 1099The independent contractor nondisclosure agreement is intended for use with workers (sometimes known as "1099 contractors" because of their tax status) who perform tasks for you or your business Unlike employees, independent contractors are not bound to maintain secrecy under most state laws That is, if you disclose a trade secret to a contractor without a nondisclosure agreement

Independent Contractor Agreement Form California New Independent Contractor Agreement Template 50 New Independent Models Form Ideas

Ontario Independent Contractor Agreement Legal Forms And Business Templates Megadox Com

That in performing under the Agreement;Agreement at the rate provided by Contractor services pursuant to this Agreement II Independent Contractor A Determination of the Manner and Means to Perform the Services;The agreement needs to make it clear that the independent contractor will be a 1099 employee, meaning that the contractor will receive a 1099 form and be responsible for payment of taxes on his or her own The contractor will need to figure these

Independent Contractor Agreement Example

Www Hws Edu Offices Pdf Independent Contractor Agreement2 Pdf

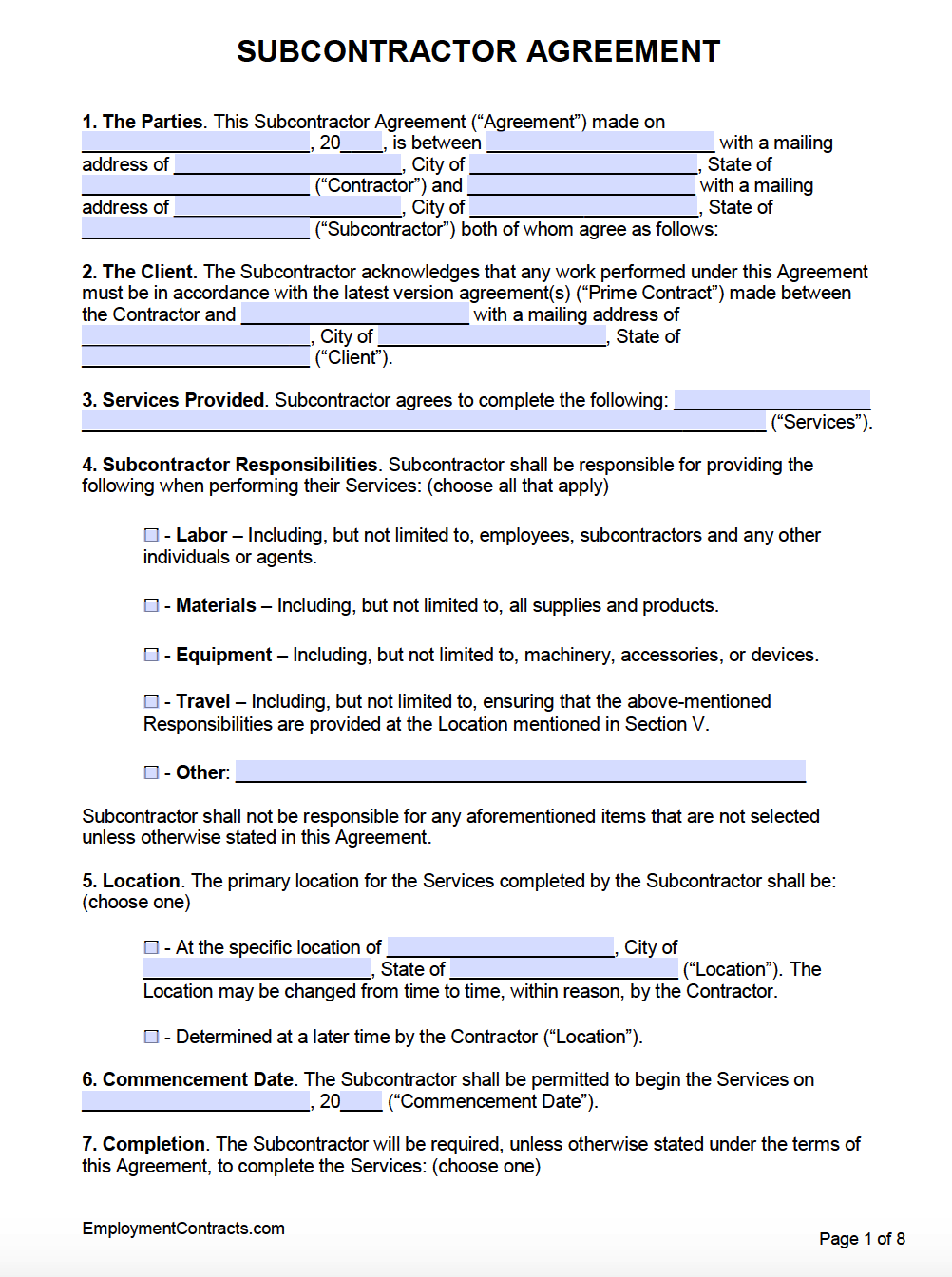

Sample 1099 Contractor Agreement purchase order Independent Contractor Agreement Word Template Templates Free 11 Subcontractor Agreement Template For Successful Contractor Truck Driver Contract Agreement Contract Agreement LeaseUnderstanding independent contractor agreement A written contract between two parties, an independent contractor agreement is used for a specific service or projectTo complete a task or project, one company hires another company for a short period using an independent contractor agreement You are wise to get this agreement signed with independent contractors to protect your interests in any IRS audit It serves to document the provider's role as a 1099 contractor as opposed to being an employee 1 Make multiple copies Put one in the file kept for the individual service provider and another in your accounting files

Www Presbyterianmission Org Wp Content Uploads Sample Indep Contractor Contract1 Pdf

Contractor Agreement Individual Free Template Sample Lawpath

Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themSLS SAMPLE DOCUMENT 06/21/18 Independent Contractor Agreement Note This document does not reflect or constitute legal advice This is a sample made available by the Organizations and Transactions Clinic at Stanford Law School on the basis set out at nonprofitdocumentslawstanfordedu Your use of this document does not create an attorney1 Definition CONTRACTOR is responsible for own taxes through a 1099 tax form at the end of every filing year;

Independent Contractor Agreement Business Taxuni

Www Mendocinocounty Org Home Showdocument Id 1950

Sample independent contractor agreements are available online Using an independent contractor agreement template will save you time over creating an agreement from scratch The 1099NEC is needed to report how much income an independent contractor earns in a yearPayer is reporting on this Form 1099 to satisfy its account reporting requirement under chapter 4 of the Internal Revenue Code You may also have a filing requirement See the Instructions for Form 38 Amounts shown may be subject to selfemployment (SE) tax Individuals should see the Instructions for Schedule SE (Form 1040) Corporations, Spreadsheet or 1099 Excel Template Spreadsheets are a great way to track both your income and your expenses as an independent contractor To get started, create four columns They should be labeled item, cost, date, and then receipt You can make notes about where the receipt is located (maybe an email folder or a physical file)

Pin On Agreement Template

50 Free Independent Contractor Agreement Forms Templates

And (c) the Services andOrder and Sequence of Work Contractor shall have the sole right and responsibility to determine the manner, method, and means of performanceIf required by the Contractor, a Performance Bond and a Payment Bond in a form satisfactory to the Contractor shall be furnished in the full amount of this Agreement These bonds will be furnished by an insurance company on the list of Acceptable Sureties by the Department of the Treasury within the limits stated thereon 9 CHANGE ORDERS

Consulting Agreement Template Download Printable Pdf Templateroller

Contractor Agreement Individual Free Template Sample Lawpath

An independent contractor may need to file a 1099MISC form with the IRS to report freelance earnings A company employing independent contractors, will need to complete a 1099MISC form if payments to individual contractors reach a threshold set by the IRSSize 86 KB Download Prior to taking up a particular task or service, a contractor safety agreement form also needs to be defined with accurate information so that in the case of any injury or mishap, the contractor and the company can face and act in theThe Compensation Split Agreement Team Splits are compensated as and reported on a 1099 federal income tax form as identified in the above "Relationship" clause Loan Processing All loans are to be processed by a company approved contract processor Originator is

Free Independent Contractor Agreement Template For 21 Bonsai

Free Independent Contractor Non Disclosure Agreement Nda Pdf Word Docx

INDEPENDENT CONTRACTORAgreement for Independent (IRS Form 1099) Contracting Services Review ListThis review list is provided to inform you about this document in question and assist you in its preparation You are wise to get this agreement signed with independent contractors to protect your interests in any IRS auditIRS 1099MISC Form – To be filed by the payor of an independent contractor of any individual that was paid more than $10 in royalties, $600 in payments, or $5,000 of a buyer for resale Contractor Work Order – An outlined request that is made prior to a job being assigned that gives a quote of the costs attributed to the labor and materials associated with the work Independent Contractor Agreement Template Sample from 1099 agreement template free , sourcetemplatesampleblogspotcom

Newportbeachca Gov Home Showdocument Id

Sample Independent Contractor Agreement

Professional Services Agreement For 1099 Representative Start Date _____ This AGREEMENT made and entered into by and between Mach4Marketing, having an address of Dayton Ln, Temecula, CA (hereinafter AGREEMENT CONTRACTOR agrees to accept and hold CONFIDENTIAL INFORMATION obtained from COMPANY in confidence at all times during andINDEPENDENT CONTRACTOR AGREEMENT SALES AGENT This Agreement entered into on the ____ day of _____, ___, between Doctor Backup, LLC (hereinafter referred to as "the Company") and _____ (hereinafter referred to as "the Agent") shall remain in effect from this date until terminated by either party1Year Subscription Price $3499 Buy Now Independent Contractor Agreement for Direct Salesperson (for Firm) When you're hiring someone to sell consumer products as a direct salesperson, it's important to establish your company's relationship with the worker protect your interests with this independent contractor agreement

Product Hiring Independent Contractor The Legal Paige

Independent Contractor Agreement Free Contractor Templates 360 Legal Forms

Tax Worksheet for Selfemployed, Independent contractors, Sole proprietors, Single LLC LLCs & 1099MISC with box 7 income listed Try your best to fill this out If you're not sure where something goes don't worry, every expense on here, except for meals, is deducted at the same rateAny customer as a house account, without the Representative's agreement 6 Independent Contractor It is understood that the Representative is an independent contractor, and nothing contained in this Agreement shall be construed as appointing the Representative as an employee of the Company Correspondingly, it is understood thatContractor, and the Independent Contractor hereby accepts employment 2 Start Date The term of this Agreement shall commence on _____, ____ Either party may, without cause, terminate this Agreement by giving ____ day(s') written notice to the other 3 Services Provided The Employer shall pay to the Independent Contractor and the

3

Http Www Naaa Com Pdfs Legal Documents Sample Ind Contract Pdf

Client will not require Contractor to rent or purchase any equipment, product, or service as a condition of entering into this Agreement 5 Independent Contractor Status Contractor is an independent contractor, and neither Contractor nor Contractor's employees or contract personnel are, or shall be deemed, Client's employeesA business owner needs an Independent Contractor Agreement for several reasons Setting Expectations An Independent Contractor Agreement explicitly sets out the expectations and parameters of the work to be done, the compensation, and the nature of the relationship itselfIt is a clearcut explanation of the expected workflow, how communication will be handled, and how Sample 1099 Contract Free 8 Employment Termination Agreement Templates In Pdf Ms Word / How do i get my w2 form?

Independent Contractor Commission Agreement Online Business Templates At Allbusinesstemplates Com

Independent Contractor Contract Sample Free Printable Documents Contractor Contract Independent Contractor Construction Contract

It was a stated agreement for commission from sales All of coupon codes are verified and tested today! Settlement for Unbiased (IRS Shape 1099) Contracting Products and services _____, known as CONTRACTING PARTY, and _____, known as INDEPENDENT CONTRACTOR, agree Click on right here for PDF model Because the tempo of Executive downsizing continues to extend, terminations for comfort–cancellations of contracts by means of the Executive just because its

50 Free Independent Contractor Agreement Forms Templates

Write A Freelancer Contract By Margaretmoon Fiverr

Construction Contract Template Free Download Unique 50 Free Independent Contractor Agreement Forms Contract Template Contractor Contract Independent Contractor

How To Insert Smartfields Into Your Contracts Signature Electronique

Free Independent Contractor Agreement Templates Pdf Word Eforms

Independent Contractor Agreement Form Free Download

Www Brotherhoodmutual Com Resources Safety Library Risk Management Forms Independent Contractor Sample Agreement

Free Independent Contractor Agreement Pdf Word

Free Independent Contractor Agreement For Download

Truck Driver Independent Contractor Agreement New Truck Driver Contract Agreement Template 21 Awesome Trucking Pany Models Form Ideas

1099 Contract Employee Agreement

Free Colorado Independent Contractor Agreement Word Pdf Eforms

Sample Independent Contractor Agreement

Blank Contractor Agreement Fill Online Printable Fillable Blank Pdffiller

高级independent Contractor Agreement 样本文件在allbusinesstemplates Com

30 Simple Independent Contractor Agreements 100 Free

Free Handyman Contract Free To Print Save Download

Printable Independent Contractor Agreement Real Estate

Http Www Otago Ac Nz Humanresources Otago Pdf

Hmsa Com Portal Provider Sample Quest Integration Agreement Independent Contractor Pdf

Uk Independent Contractor Agreement Form Legal Forms And Business Templates Megadox Com

Project Contract Agreement Sample

Free Independent Contractor Agreement Template Download Wise

Free Printable Independent Contractor Agreement Simple Form Generic

3

Www Gc Cuny Edu Cuny Gc Media Cuny Graduate Center Pdf Office of business and finance Purchasing dept Ica Independent Contractor Agreement Pdf

Hair Stylist Contract Template Breach Of Contract Independent Contractor

Independent Contractor Agreement Bestdox

Free Freelance Writer Contract Free To Print Save Download

Independent Contractor Agreement Template Download Printable Pdf Templateroller

Independent Contractor Contract Template The Contract Shop

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Real Estate Salesman Independent Contractor Agreement Template By Business In A Box

Www Theharriscenter Org Portals 0 Current solicitation documents Contracts and real estate Sample contract inpatient pyschiatric beds jail diversion 18 Pdf

Consulting Agreement Template Us Lawdepot

Free Independent Contractor Non Compete Agreement Pdf Word

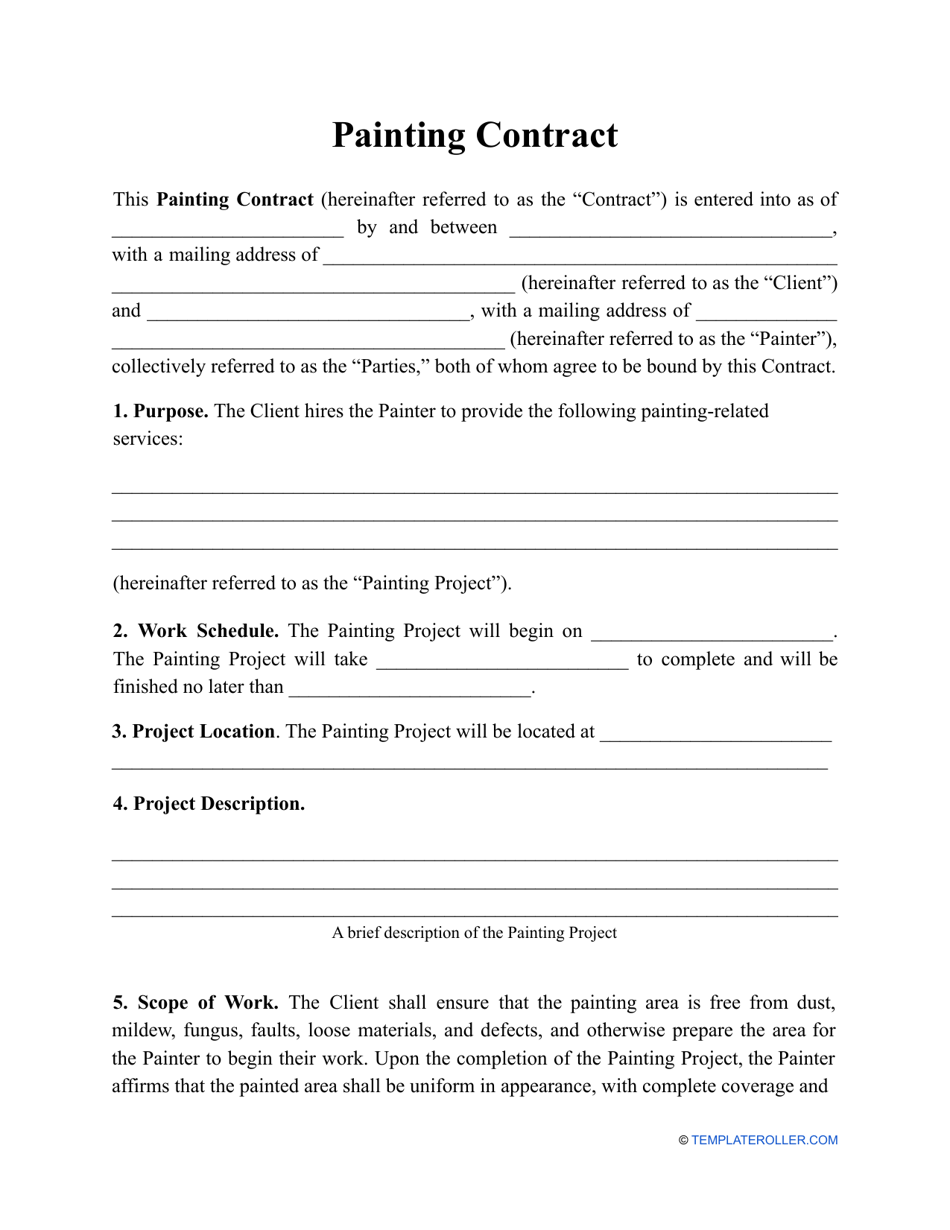

Painting Contract Template Download Printable Pdf Templateroller

Free One 1 Page Independent Contractor Agreement Pdf Word Eforms

3

Www Fairwork Gov Au Articledocuments 766 Sample Clauses For Contractors Template Pdf Aspx

Free Independent Contractor Agreement Create Download And Print Lawdepot Us

Sample Independent Contractor Non Compete Agreement Word Pdf

Free Subcontractor Agreement Template Pdf Word

50 Free Independent Contractor Agreement Forms Templates

Independent Contractor Agreement Template Approveme Free Contract Templates

Agreement For Service S For Self Employed Independent Contractors Contract Management Policies Procedures Related Guidance Hr The University Of Sheffield

Free Independent Contractor Agreement For Download

Newportbeachca Gov Home Showdocument Id

50 Free Independent Contractor Agreement Forms Templates

Http Www Coloradoanesthesiaservices Com Images Fulltime Pdf

Free Independent Contractor Agreement For Download

Contractor Agreement Individual Free Template Sample Lawpath

Contract Agreement Sample Sample Contractor Agreement Template Word An Agreement Form Also Known As A Contract Document Can Be Drawn Up In A Simple Contract Format Or Agreement Format

2

Independent Contractor Agreement Template Proposable

Independent Contractor Agreement Template By Business In A Box

3

Independent Contractor Agreement Legal Goodness

Http Www Theceshop Com Webapp Asset Storage Etsassets Synegen Com Ces Cms Dev Pdf F35d13 5c 40c2 Bfae Edd2e261a571 Independent Contractor Agreement For Real Estate Agents Pdf

Independent Contractor Agreement The Association Of Fitness Studios

Independent Contractor Agreement Template Easy Legal Templates

Www Legalzoom Com Download Pdf Independent Contractor Agreement Pdf

Simple Contract Agreement Templates Contract Agreement Forms Project Management Small Business Guide

Free Independent Contractor Agreement Template Download Wise

Independent Contractor Agreement Programming Modele Professionnel

1099 Form Independent Contractor Agreement

Free Independent Contractor Non Disclosure Agreement Nda Template Pdf Word

Erd Dli Mt Gov Docs Work Comp Regs Sample Memo Of Understanding Pdf

Online Course Creator Bundle Awb Firm

Contract Forms Free Printable Documents Contract Contractor Contract Independent Contractor

Www Cdha Ca Pdfs Career Students Ssec Pdf

Eea Agreement

1099 Form Independent Contractor Agreement Unique 1099 Form Independent Contractor Agreement Example Forms For Models Form Ideas

50 Free Independent Contractor Agreement Forms Templates

Free Independent Contractor Agreement Templates Word Pdf

Free Printable Independent Contractor Agreement Form Contractor Contract Construction Contract Contract Template

No comments:

Post a Comment