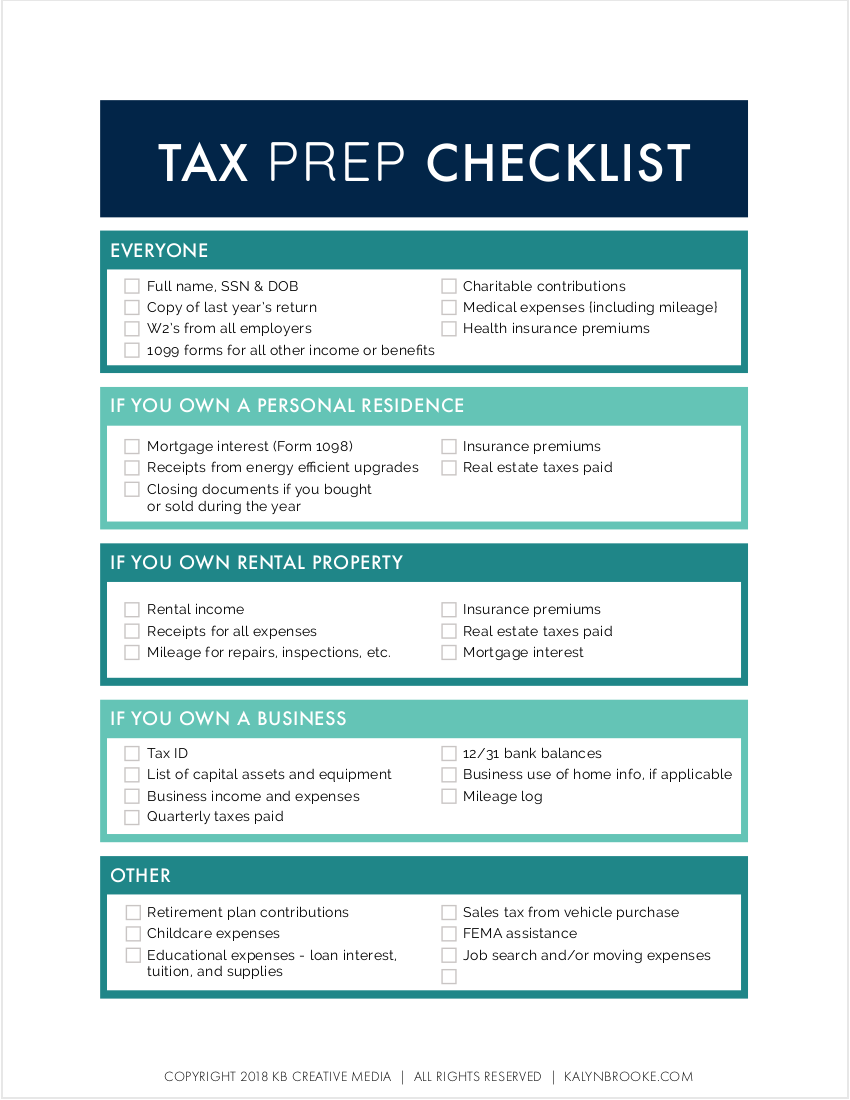

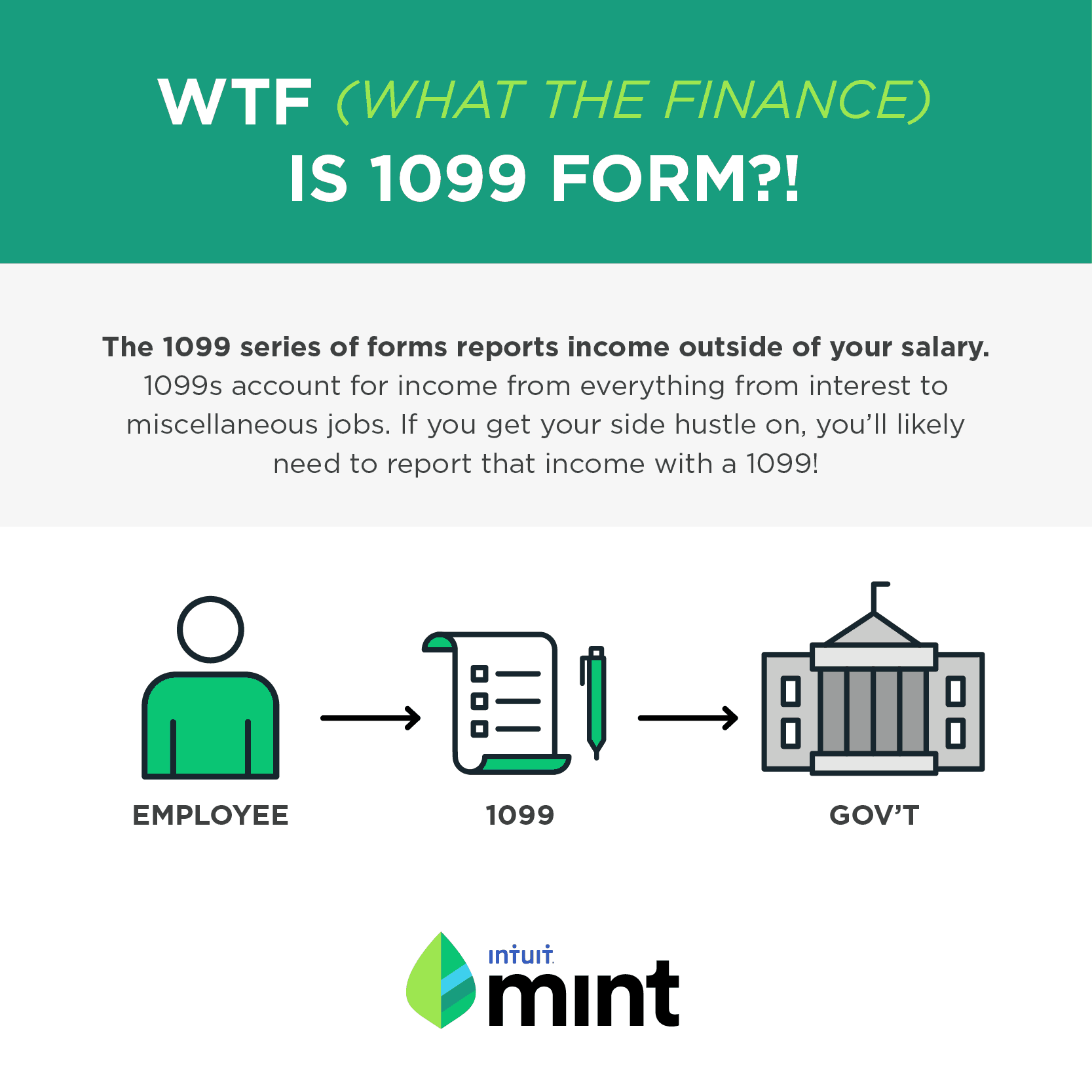

Get Your Free 'Cheat Sheet' to Quickly Know the Ordinances in Your State Save time and frustration!A cheat sheet to make sure you have all the right answers If you know which form(s) they'll send you (1099B, 1099DIV, 1099INT, etc), list them separately If you have distributions from a retirement plan, including a rollover or backdoor Roth, don't forget the 1099R Taxes Paid2 Working with the nix store 21 Get the store path for a package 211 Adding files to the store;

Ace Tax Cheat Sheet For Athletes

1099 cheat sheet

1099 cheat sheet-1099 Due Diligence Starts with the W9 Name and TIN "Cheat Sheet" Cont'd 1099 Due Diligence Starts with the W9 When To Get An Updated Form W9 1099 Due Diligence Starts with the W9 Payee Refuses to Provide TINDeductible Items Should you need to take this list with you or need a print out, please click on Deductible Items Cheat Sheet Lumper Fees Magnifying Glass Map Light Maps Meals & Entertainment Medical Money Order Exp Motel/Hotel Expense Office Supplies Oil and/or Additives Paper Towels

Spray Tan Tax Tips Bronzedberry Spray Tan Certification And Studio

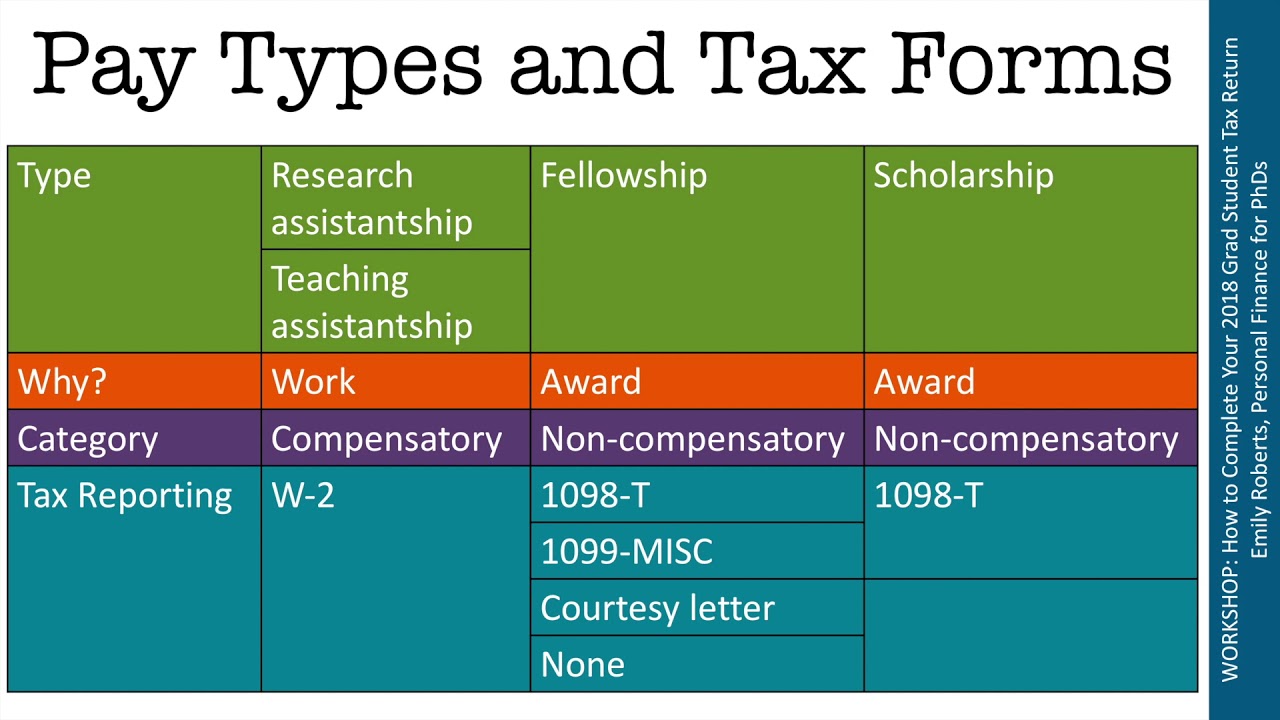

Yourself and/or you may receive Form 1099MISC, Miscellaneous Income Also, any tips you receive, such as tips received as a taxicab driver, or bonuses received as a truck driver in cash, are taxable income And the sale of any of your equipment or workrelated purchases also constitute taxable income (ie sales of tires, radios, etc)This free cheat sheet lists the Paid Sick Leave ordinances for each State/City/County1099 Essentials Starts With The W9 Name and TIn "Cheat Sheet" ;

You need receipts, invoices, or documentation for all the expenses you plan to enter hereContents Trailin and Trailout Periods135 Cost Share Calculations136 6Step Cheat Sheet for LastMinute Filing by Susannah McQuitty You got this—all you have to do is start!

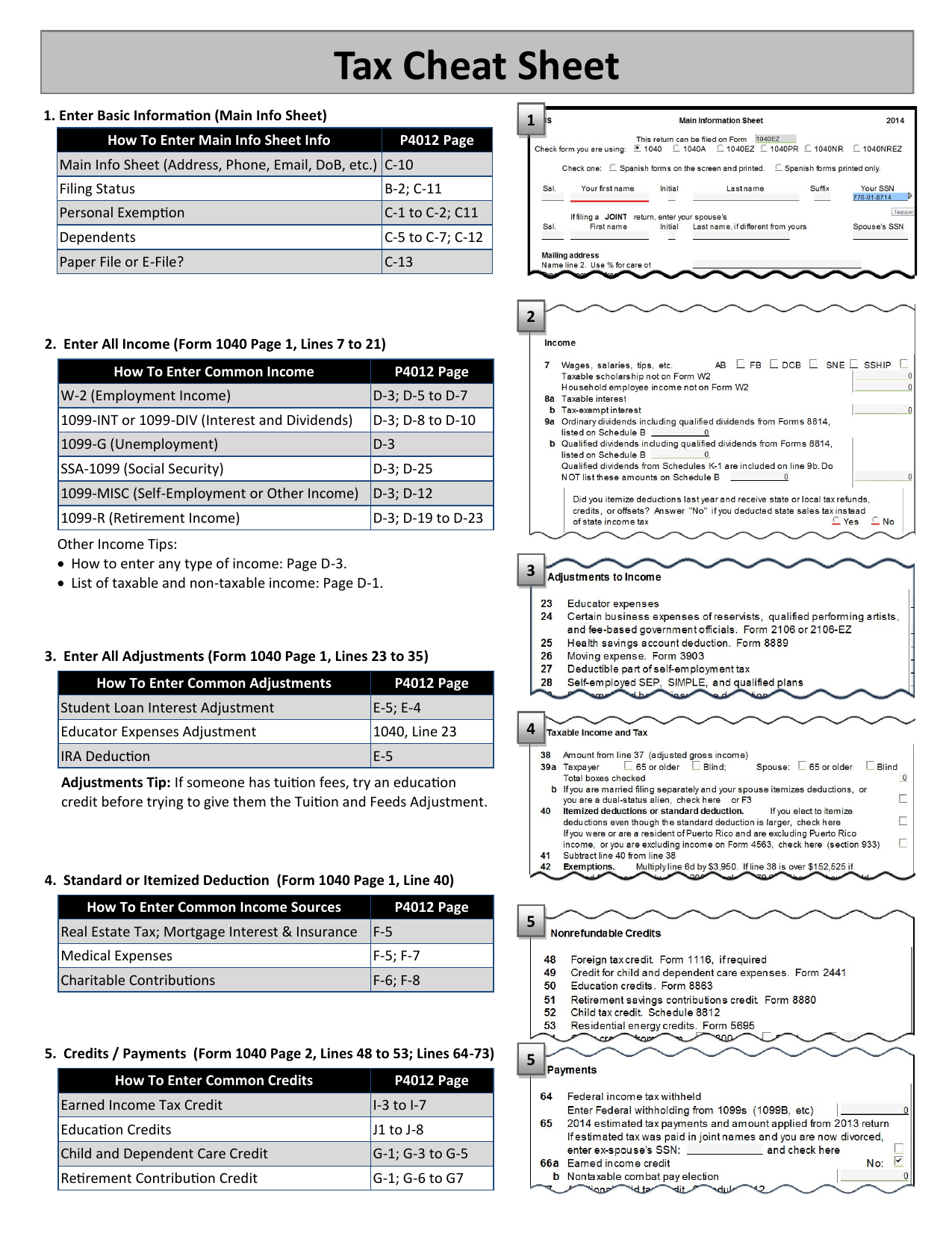

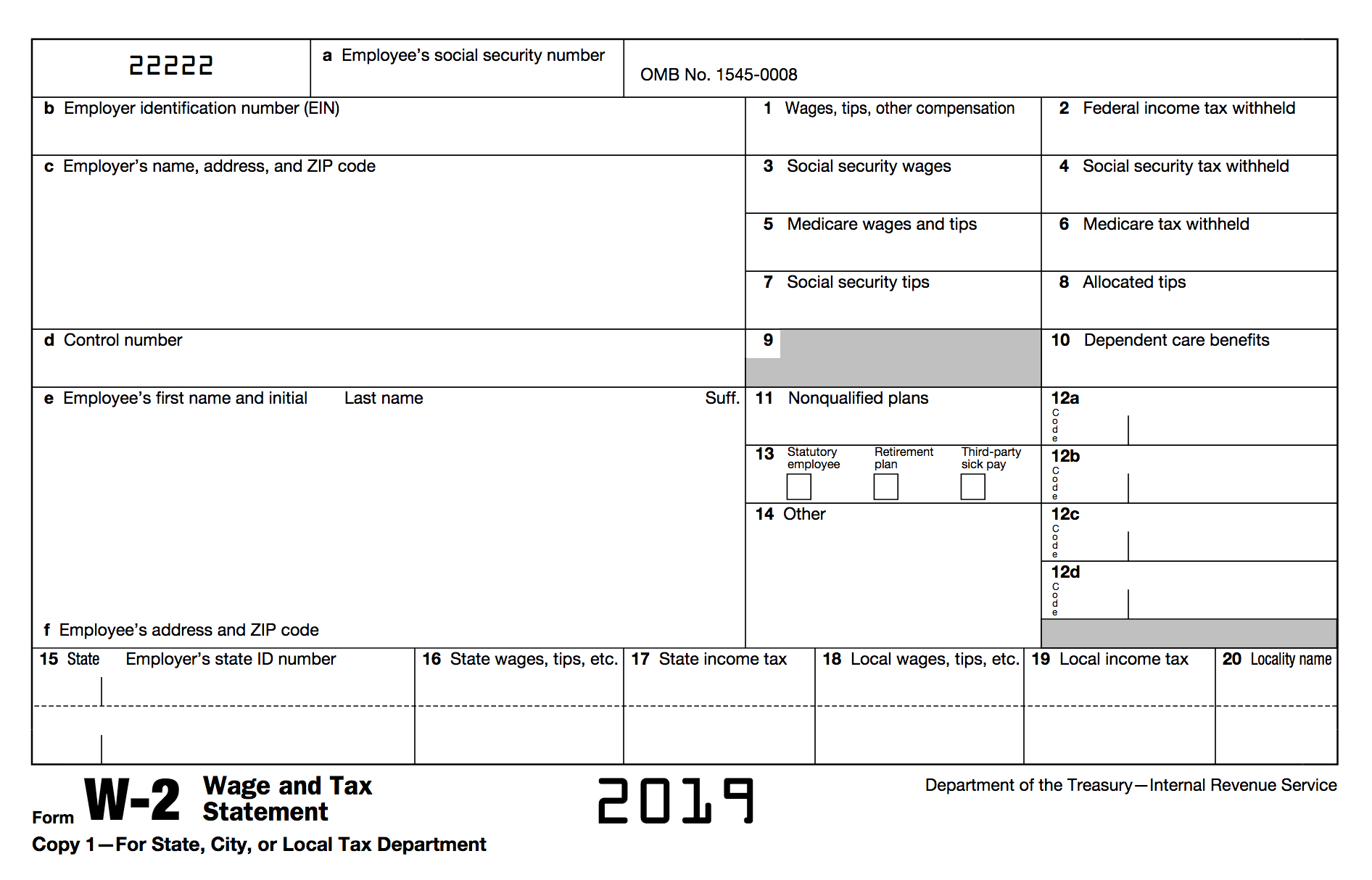

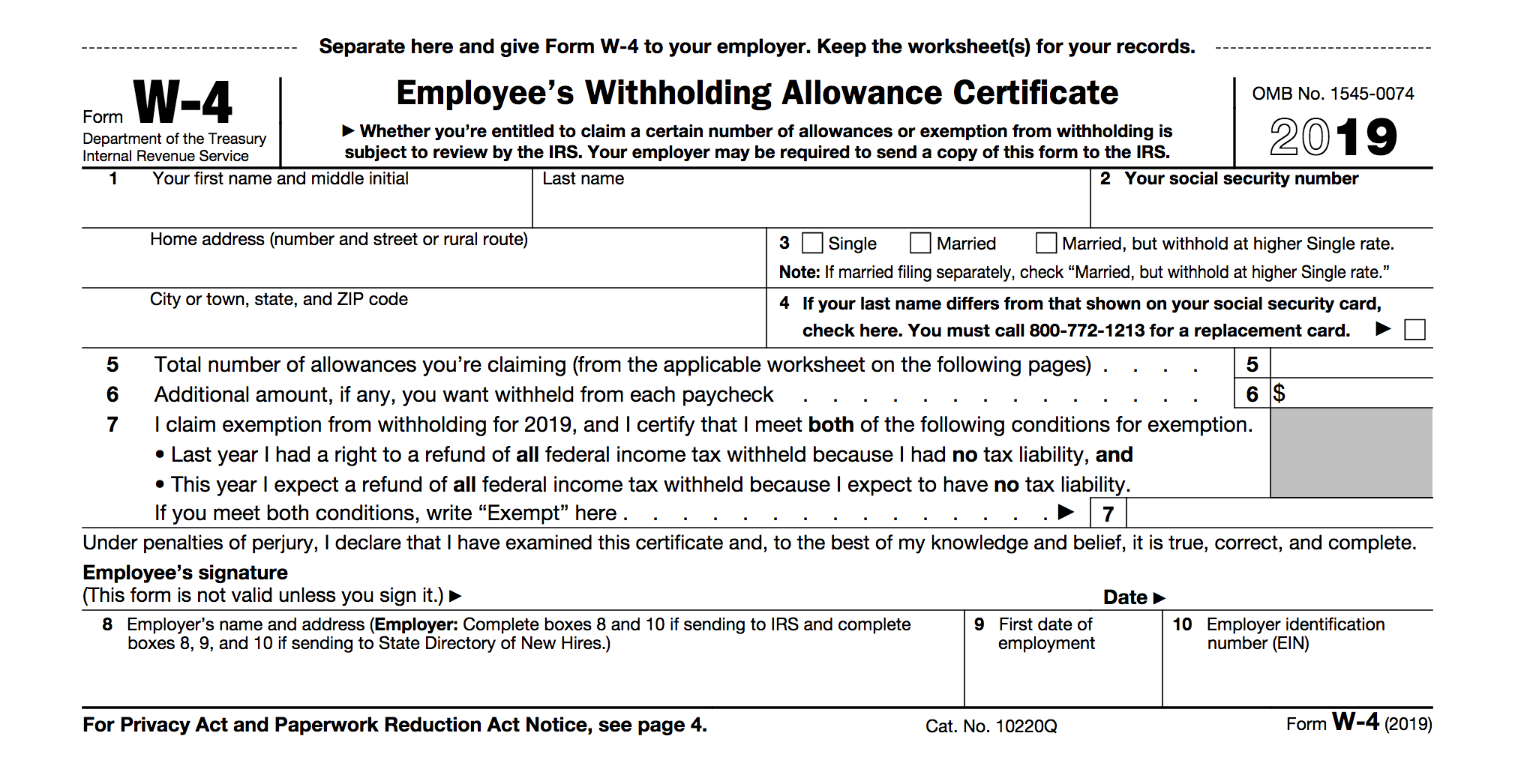

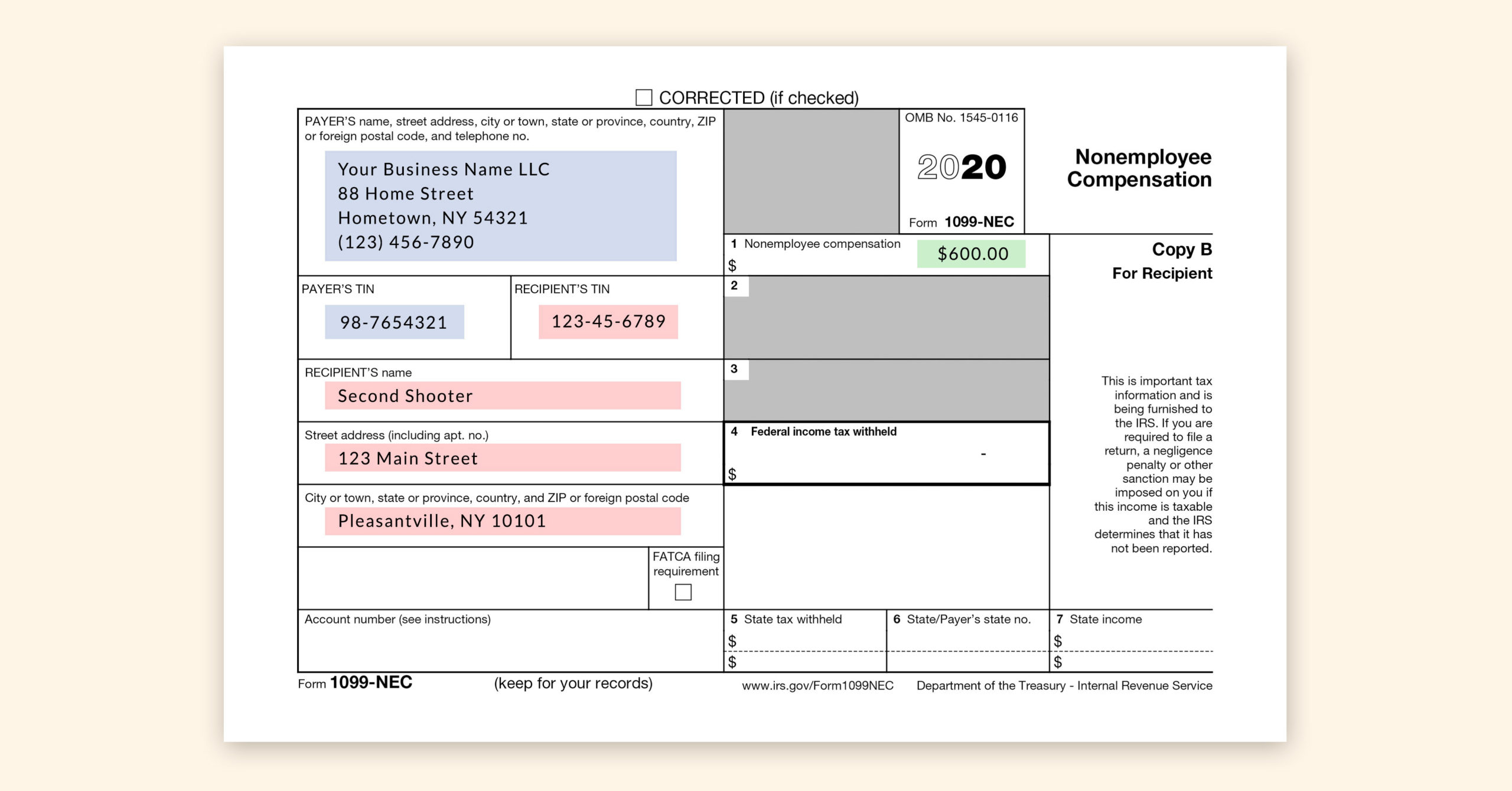

We make filing taxes delightfully simple with one, flat–rate price Every feature included for everyone You get your W2 from your employer, or a 1099NEC from a client, and the filing process kicks off as you transfer numbersCheat Sheet For more detailed, stepbystep instructions on how to enter the form into ProSeries, please refer to the ProSeries Tax Manual Form 1099B Capital Gains/Losses Schedule D X "D" Form 1099C Cancelled Debt Form 1099C "1099C" Form 1099DIV Dividends Schedule B – Part II X "B" Form 1099G1099 Essentials Starts With The W9 When To Get An Updated Form W9 ;

9 Frequently Asked Questions 1099 S Sage Intacct Blog Cla Cliftonlarsonallen

1040 Income Tax Cheat Sheet For Kids Consumer Math Financial Literacy Lessons Consumer Math High School

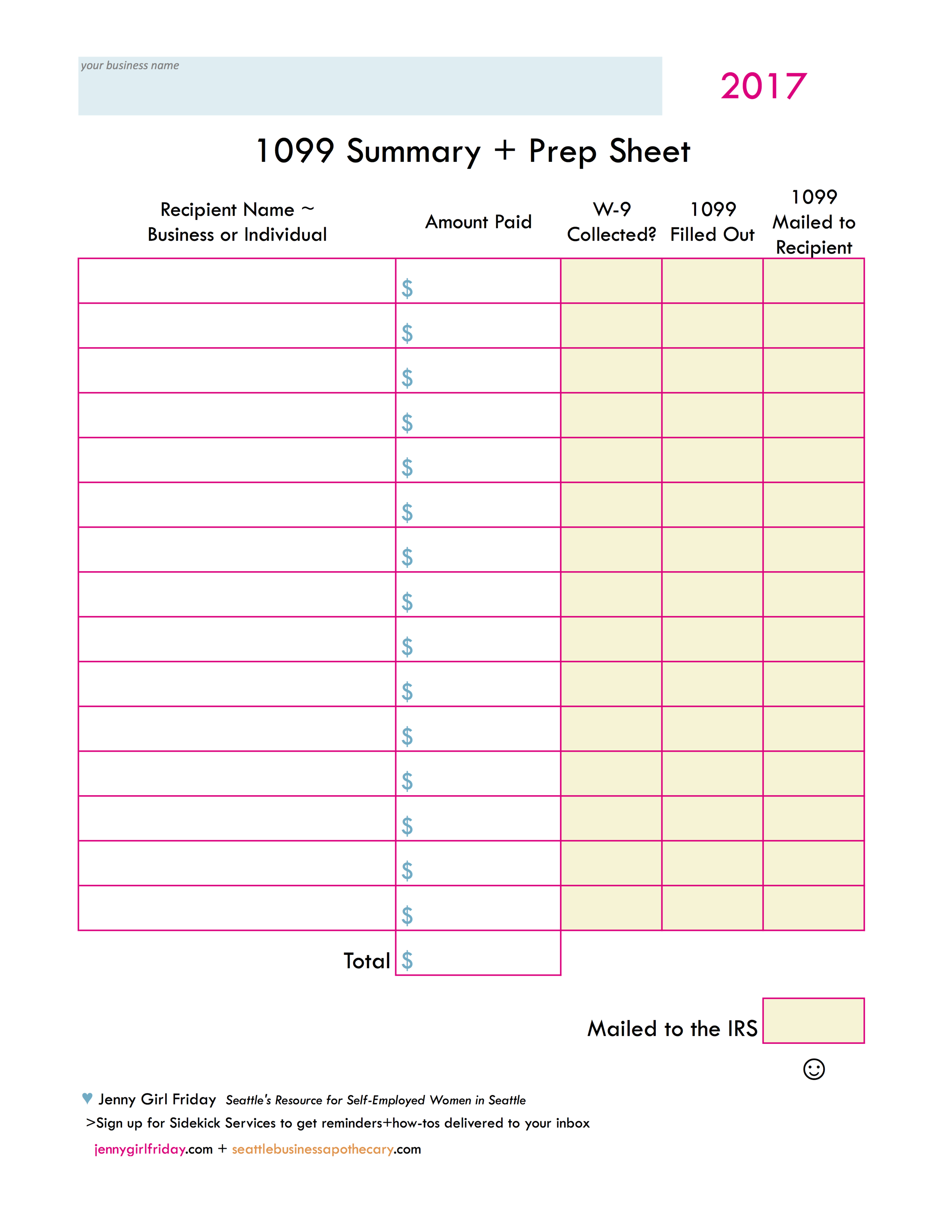

Here's a quick cheat sheet to help *anyone who provides a service, not a product *anyone who you pay over $600 within the calendar year (except lawyers) *any LLC or sole proprietors23 Evaluate a NixOS configuration without building;If you would like Stephano Slack to handle your 1099 preparation, please contact Samantha Wolf no later than December 1 st, 17!

Ace Tax Cheat Sheet For Athletes

How To Crack The 1099 Misc Code Avoid Penalties With These Tips

If you are planning on taking on your 1099 preparation yourself – contact Samantha Wolf at swolf@stephanoslackcom for a onepage cheat sheet!Check out the instructions for more info, but in general, you're required to issue a 1099 SCHEDULE C CHEAT SHEET Part II Expenses Here's where you enter all those business deductions you've been keeping excellent track of all year!Published on • 3 Likes • 0 Comments Report this post;

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

Rural Health Clinic Billing Cheat Sheet Fill Online Printable Fillable Blank Pdffiller

There was a problem previewing Codes Cheat Sheet pdf Retrying25 Building a service as a VMIncluded with this cheat sheet so you'll never again have to wonder if a vendor will need to "be 1099'd" at yearend The number one question to ask yourself is if you bought goods or services from the vendor 1099 forms only report the payment of services So whether you bought o!ce supplies or airplanes,

Do You Need To Issue A 1099 To Your Vendors Accountingprose

Tax Cheat Sheet Free Tax Campaign

Codes Cheat Sheet pdf Sign In Whoops!NEW CLIENT 1099 COMPANY INFORMATION SHEET 855 Bordeaux Way, Suite 170 Napa, CA Phone Fax 1412 If you are not currently a client of Payroll Masters and are requiring our services to process your 1099"s please include the following information with your "1099 Information sheet"Please call the 1099 inquiry line at to request corrections to your 1099 or a duplicate copy

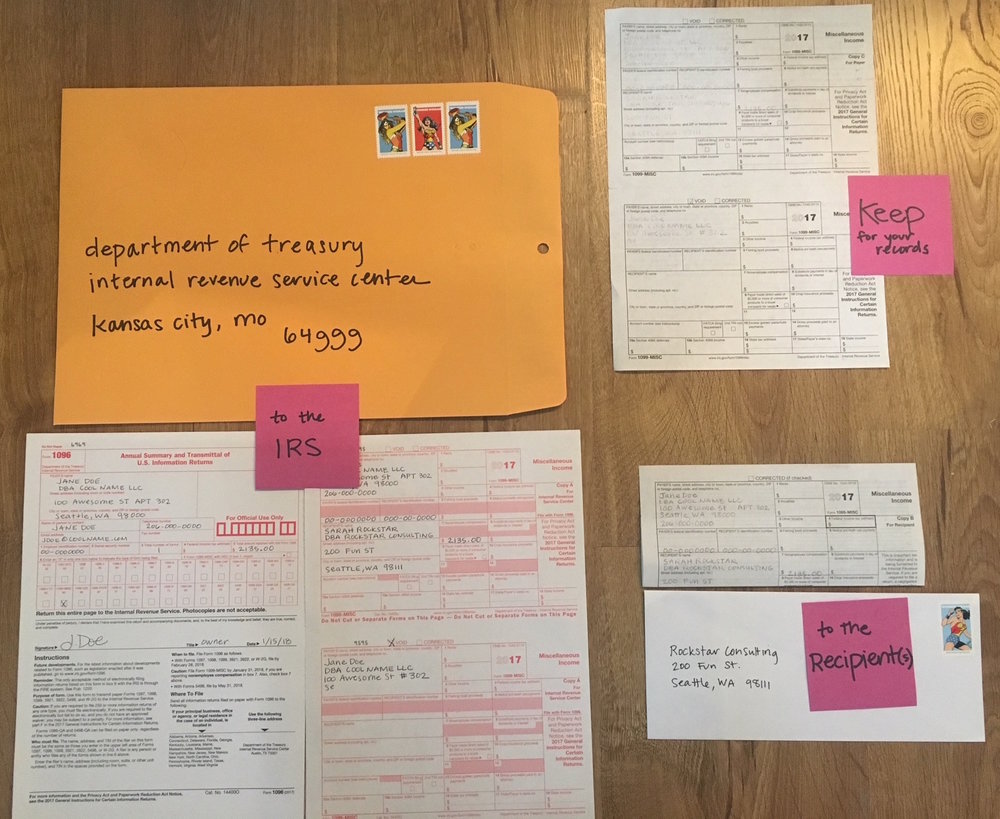

1099 Misc Forms 1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

Php Cheatsheets Visibone

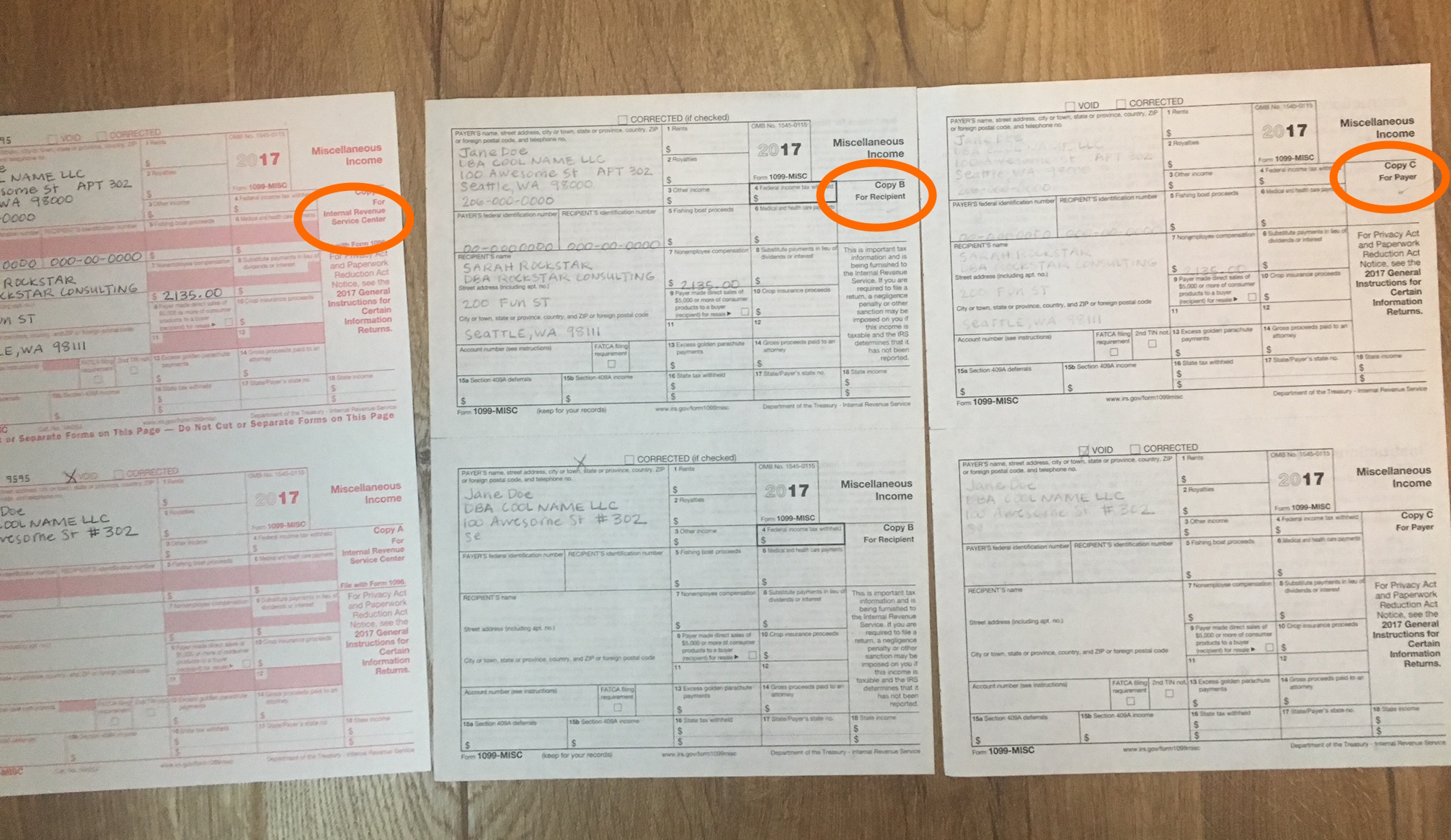

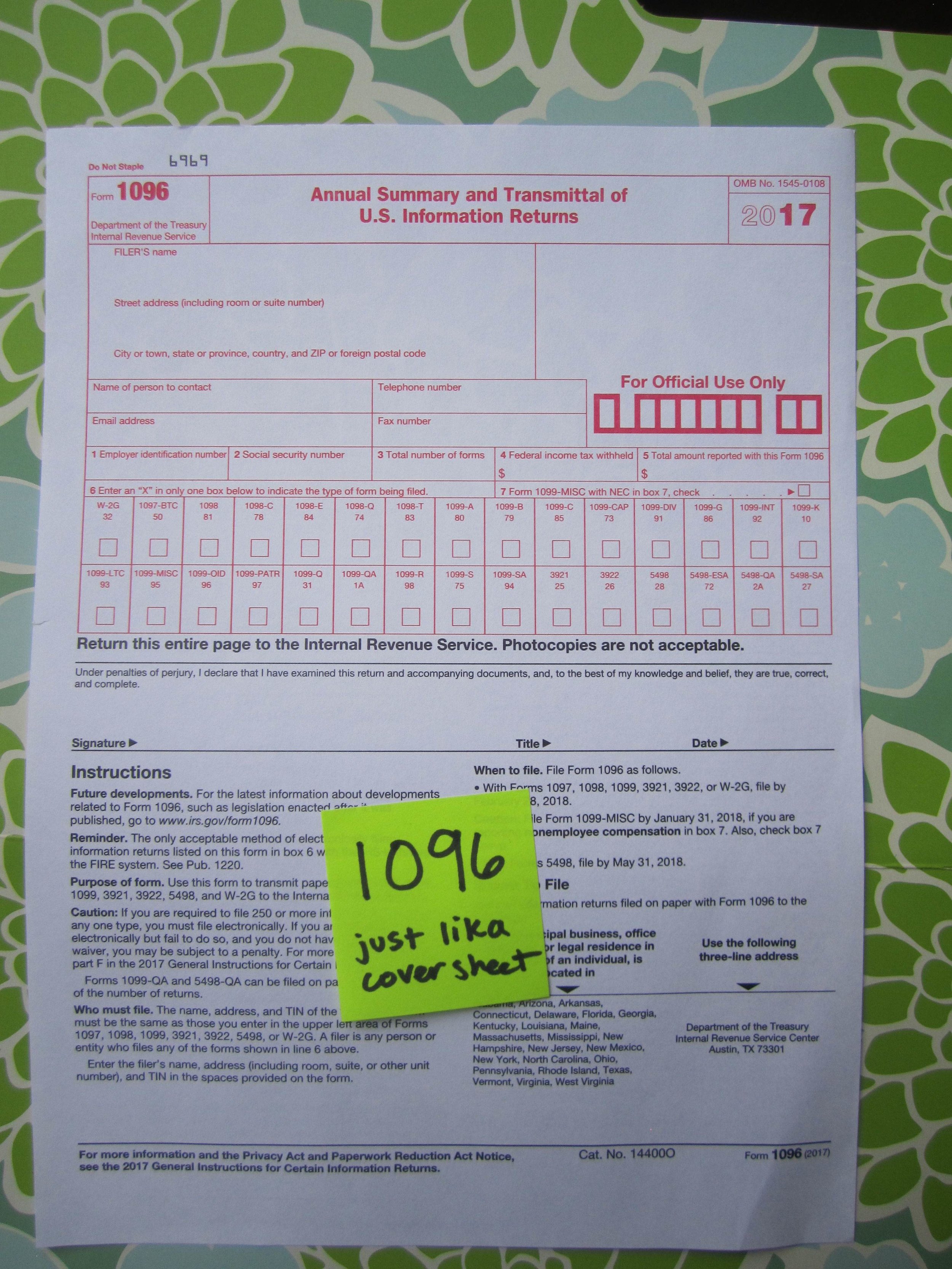

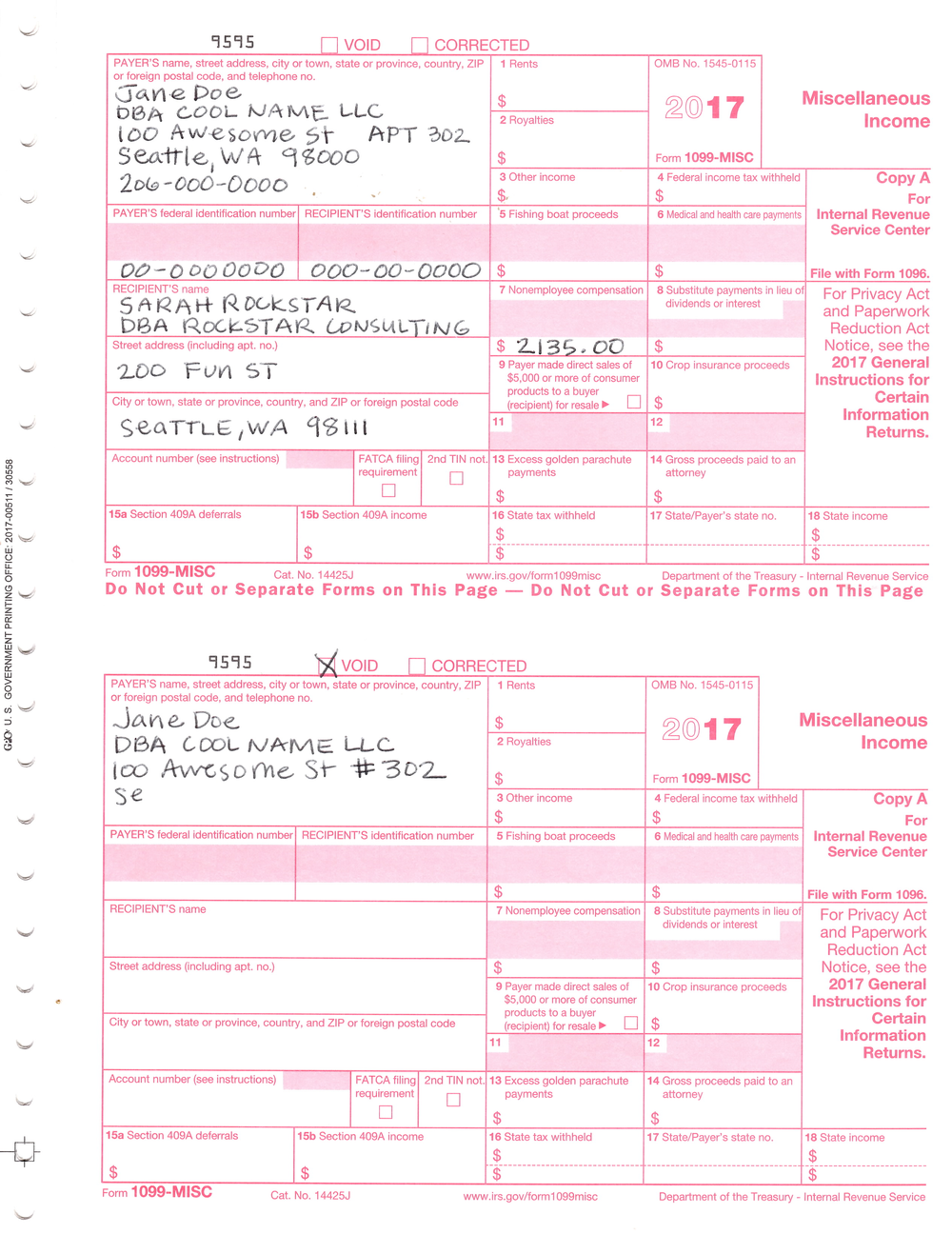

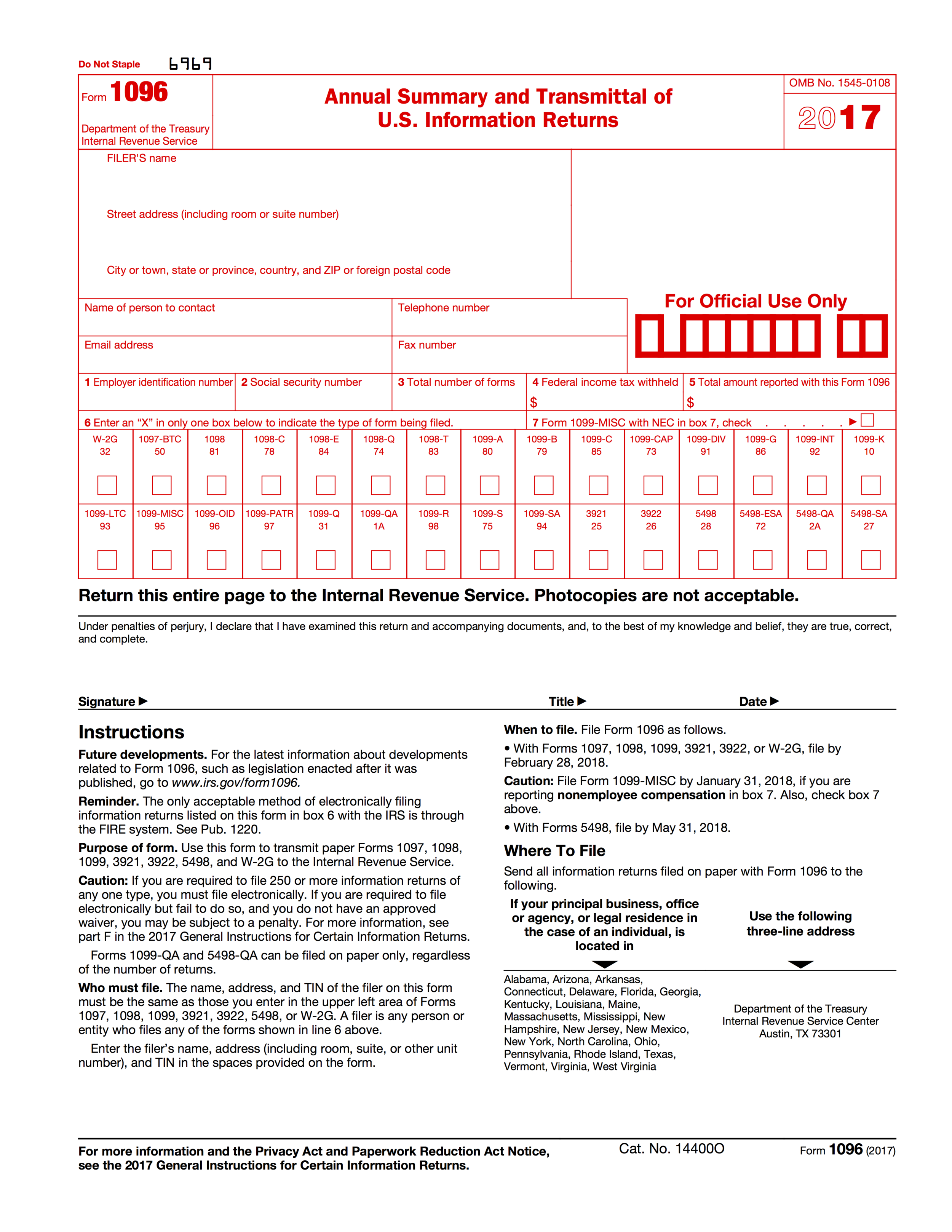

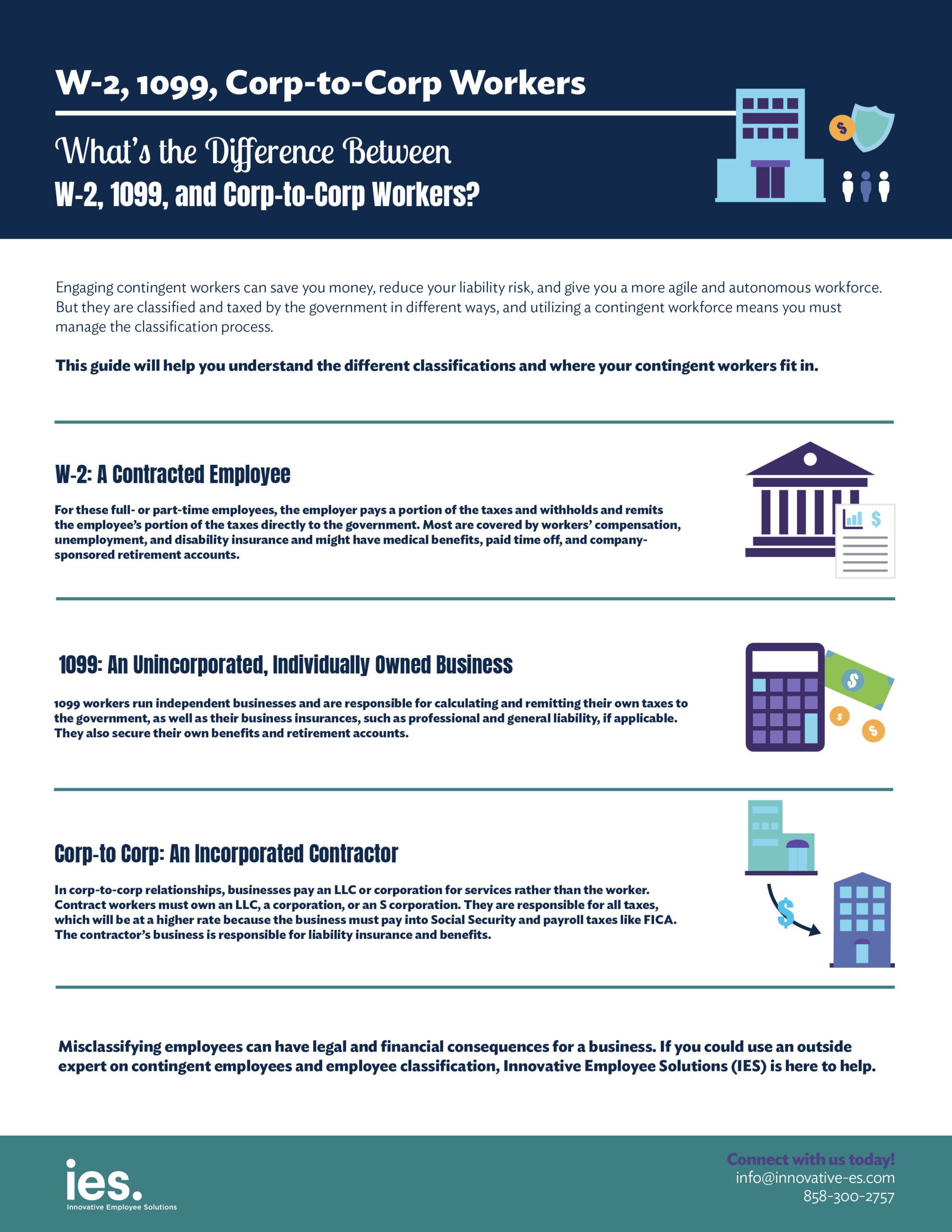

For each contractor and vendor you pay over the course of the year, instead of preparing a W2, you must complete Form 1099, Miscellaneous Income The 1099 is an information form used to report income, interest payments, and dividend payments To transmit the 1099 to the federal government, you use Form 1096, Annual Summary andFile out a new 1099MISC form and Place an X in the "VOID" box at the top of the form and then issue a new 1099 with an X in the "Corrected" box The enter in zeros for all the money amounts Send the corrected form to the IRS and make sure you send aSamantha Wolf, CPA swolf@stephanoslackcom

Www Goladderup Org Wp Content Uploads 19 11 19 Proseries Tax Manual With Headings Final Pdf

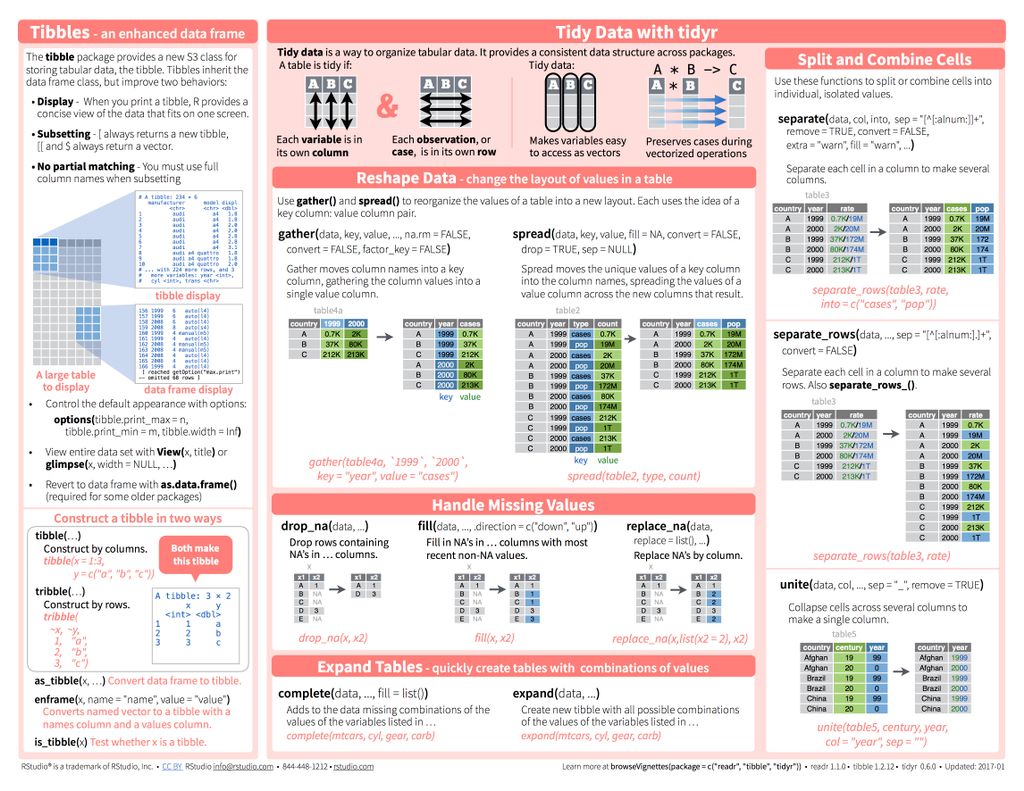

Mara Averick Woah Cheat Sheet Mania New Rstudio Data Import Cheat Sheet Wrangling Updated Too T Co 1yntp9mtsp Rstats T Co 2dyqyxsdz1

1 A NixOS cheat sheet and comparison to Ubuntu 11 Comparison of secret managing schemes;• Form 1095C Code Cheat Sheet • Form Instructions (Page 11) Forms 1094C & 1095C Reporting Requirements Tip Sheet This is not intended to provide specific direction for completing the forms or outline all possible information needed but rather, to help you think How To Complete Form 1099MISC Whenever you hire an unincorporated independent contractor to whom you pay $600 or more by check or cash during the year, you must file a 1099MISC form reporting the payments to the IRS by January 31 The information on the completed Form W9 will enable you to complete the 1099MISC correctly

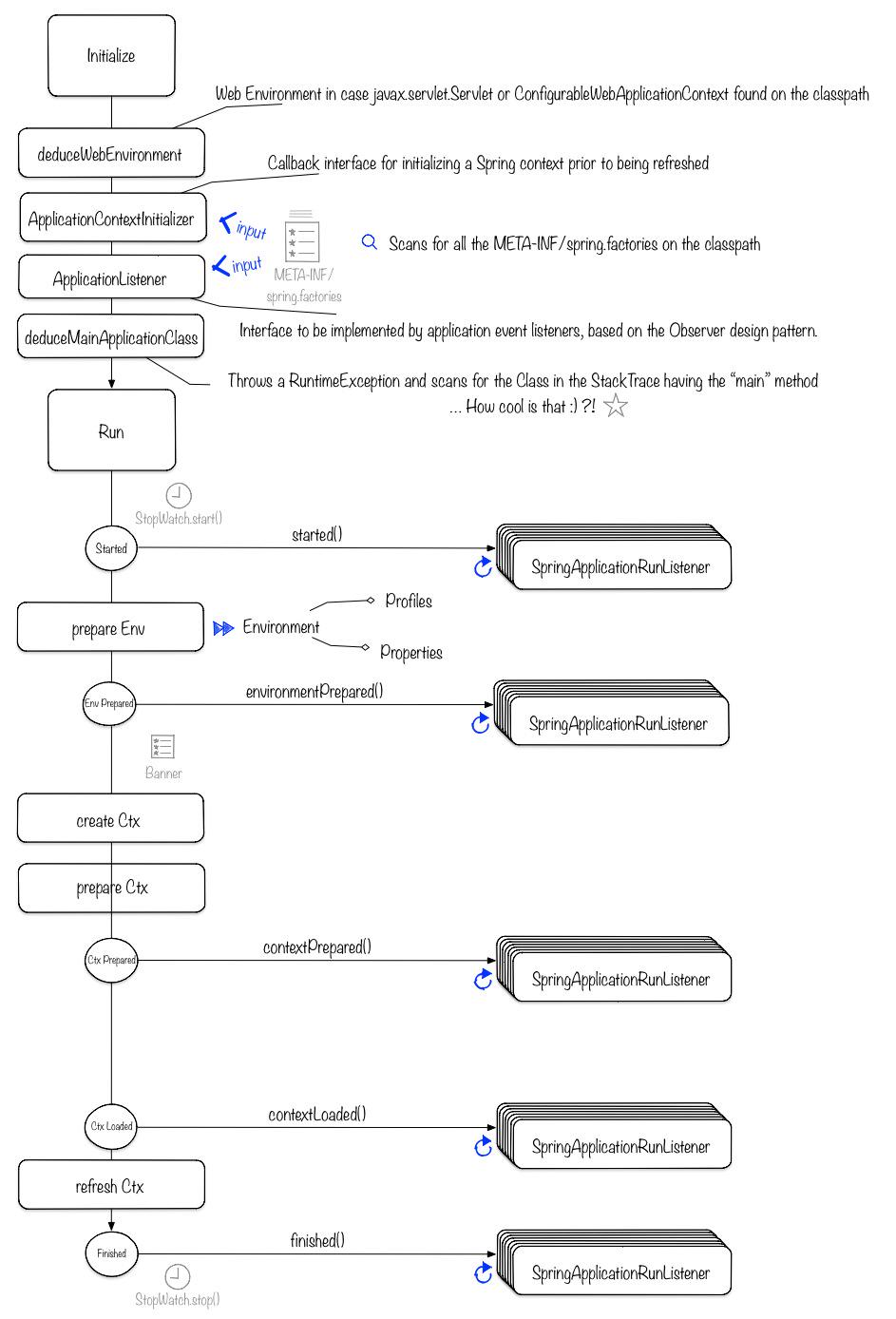

Arun Avanathan Cheat Sheet For Life Cycle Of Spring Boot Http T Co K7z0jldi9c Springboot Springframework Http T Co Erxgpnfusy

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Forms W2, W4, W9, and 1099 Cheat sheet! Raise the federal minimum wage to $855 this year and increase it over the next five years until it reaches $15 an hour in 24 After 24, adjust the minimum wage each year to keep pace with growth in the typical worker's wages Phase out the outdated subminimum wage for tipped workers, which has been frozen at a meager $213 since 19911099 Essentials Starts With The W9 Name and TIn "Cheat Sheet" (Cont'd) ;

The Simple Mileage Log You Ll Never Forget To Use

How To Crack The 1099 Misc Code Avoid Penalties With These Tips

Client Organizer/1099 Worksheet Download Your Tax Organizer A tax organizer can facilitate the process of pulling together your tax information This basic tax organizer is designed for new clients and allows you to enter your information right on the screen You can then print the completed tax organizer and fax or mail it to the office W2 vs W4 cheat sheet Here's some simple shorthand for thinking about IRS Form W2 (Wage and Tax Statement) and IRS Form W4 (Employee's Withholding Allowance Certificate) The W4 is all about input—the employee telling you what to do with their withholdings The W2 is all about output—telling the IRS what's been done in the A Tax Cheat Sheet for Kindle eBook SelfPublishing;

Breeze Through Tax Time With A Custom Cheat Sheet Colter Reed

1

Who needs to get a 1099 at the end of the year?Jon Tegeler Sales Manager (479) jon@zenworkcom18 Tax Cut Cheat Sheet for Employers The United States Congress passed the Tax Cuts and Jobs Act of 17 on Payroll Mate is helping employers and tax professionals comply with the new regulations The Payroll Mate team put together this "cheat sheet" that covers some of the common questions employers have about the new

2

Www Goladderup Org Wp Content Uploads 19 11 19 Proseries Tax Manual With Headings Final Pdf

Here's a quick cheat sheet for the actual filing Print your completed Form 1040 (the annual income tax return form) or choose to file the form electronically Sign, date, and submit the form to the IRS by April 15th You can file Form 4868 to get an extension, but this can result in fees and penalties if you have taxes due1099 WORKSHEET Use this form to provide our firm with the information needed to prepare your 1099 information returns 1099 information returns must be prepared for individuals you paid $600 or more during the tax year and filed with the IRS CAUTION The IRS routinely verifies the name and payer ID numbers on all 1099s filed If there areA Tax Cheat Sheet for Kindle eBook SelfPublishing Updated for Tax Year / 1040 AM 1099NEC Snap and Autofill Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting Available in mobile app only

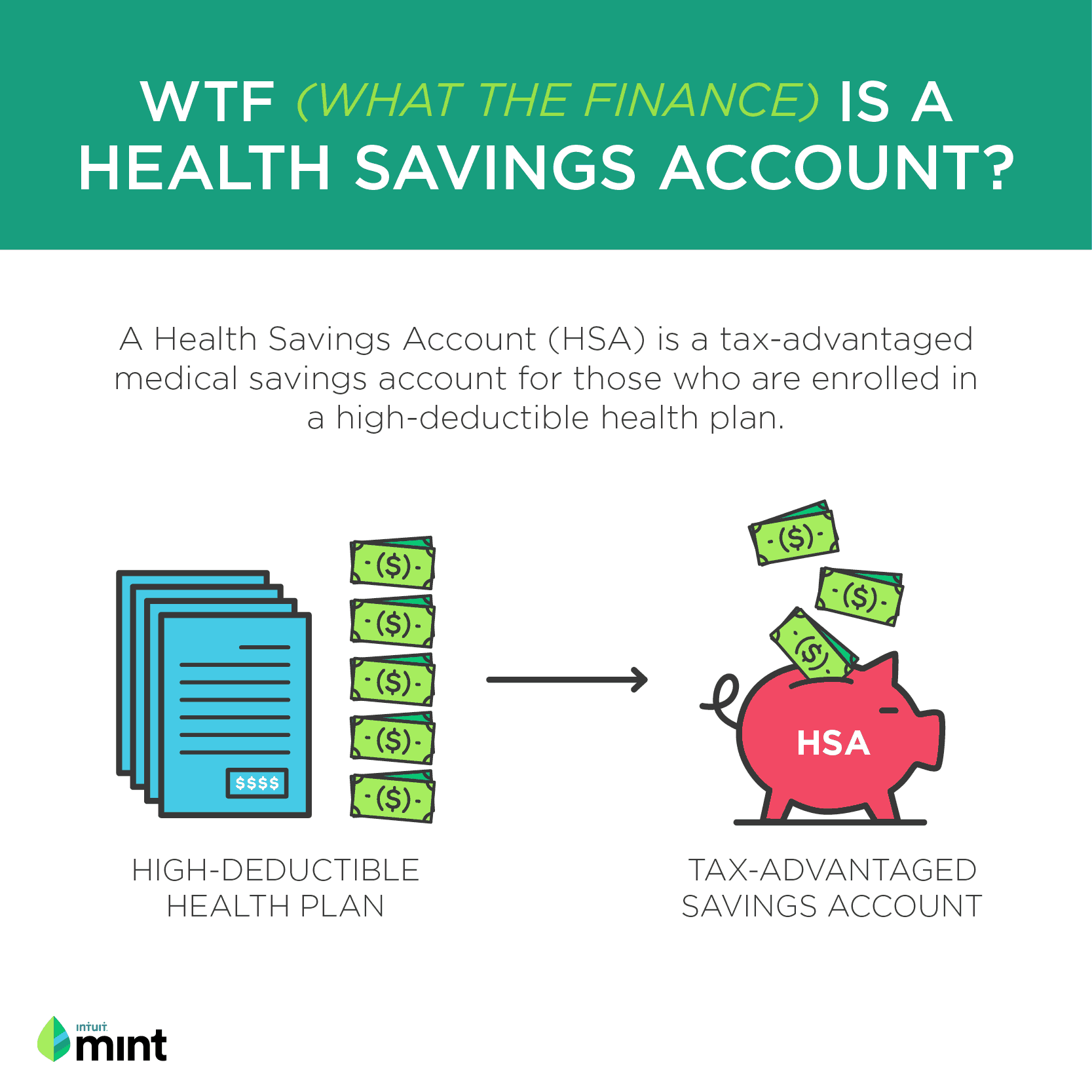

What The Finance It S Tax Time Mintlife Blog

Www Goladderup Org Wp Content Uploads 19 11 19 Proseries Tax Manual With Headings Final Pdf

Categories 1099 s 1096 10, Massachusetts 1099K Reporting, Massachusetts 1099K Reporting Requirements 18 Tax Cut Cheat Sheet for Employers The United States Congress passed the Tax Cuts and Jobs Act of 17 onThe 1099 Misc form is used to report payments made to vendors Cabot Oil & Gas will mail the forms by January 31st of each year IRS does not require 1099 Misc forms for Total payments of less than $600 in a year; Complete and Correct Form I9 All employers must complete and retain Form I9, Employment Eligibility Verification, for every person they hire for employment after Nov 6, 1986, in the US as long as the person works for pay or other type of payment In the Commonwealth of the Northern Mariana Islands (CNMI), employers have had to complete

Tax Return Archives Personal Finance For Phds

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

FS2103, February 21 — Although many cash transactions are legitimate, the government can often trace illegal activities through payments reported on complete, accurate Forms 00, Report of Cash Payments Over $10,000 Received in a Trade or Business Here are facts on who must file the form, what they must report and how to report it Nmap cheatsheet by Albert Valbuena Nmap is a discovery tool used in security circles but very useful for network administrators or sysadmins One can get information about operating systems, open ports, running apps with quite good accuracy It can even be used in substitution to vulnerability scanners such as Nessus or OpenVASGenerally, the person responsible for closing the transaction, as explained in (1) below, is required to file Form 1099S If no one is responsible for closing the transaction, the person required to file Form 1099S is explained in (2), later However, you may designate the person required to file Form 1099S in a written agreement, as

2

How To Deal With An Incorrect 1099 Form Helpful Example Pt Money Money Mindset Accounting And Finance Money Management

22 Build nixos from nixpkgs repo;Cartridges, Paper, Label Sheets, Sheet Feeders, Toner Cartridges, Wheels, etc 40 Computer Consumables Electronic Publications Directories, Dictionaries, Encyclopedias, etc (1099) 5668 NonRelated Research Services(1099) NonRelated Research Services (1099) 5670 Other Contracted ServicesTesting Heuristics Cheat Sheet Testing Wisdom A test is an experiment designed to reveal information or answer a specific question about the software or StudyMode Premium and Free Essays, Term Papers & Book Notes Sign Up (1099 words) Published

What If A Contractor Or Vendor Refuses To Provide A W 9 For A 1099 Politte Law Offices Llc

Www Opportunityfund Org Wp Content Uploads 05 Ppp Loan Amount Document Cheat Sheet April 30 Pdf

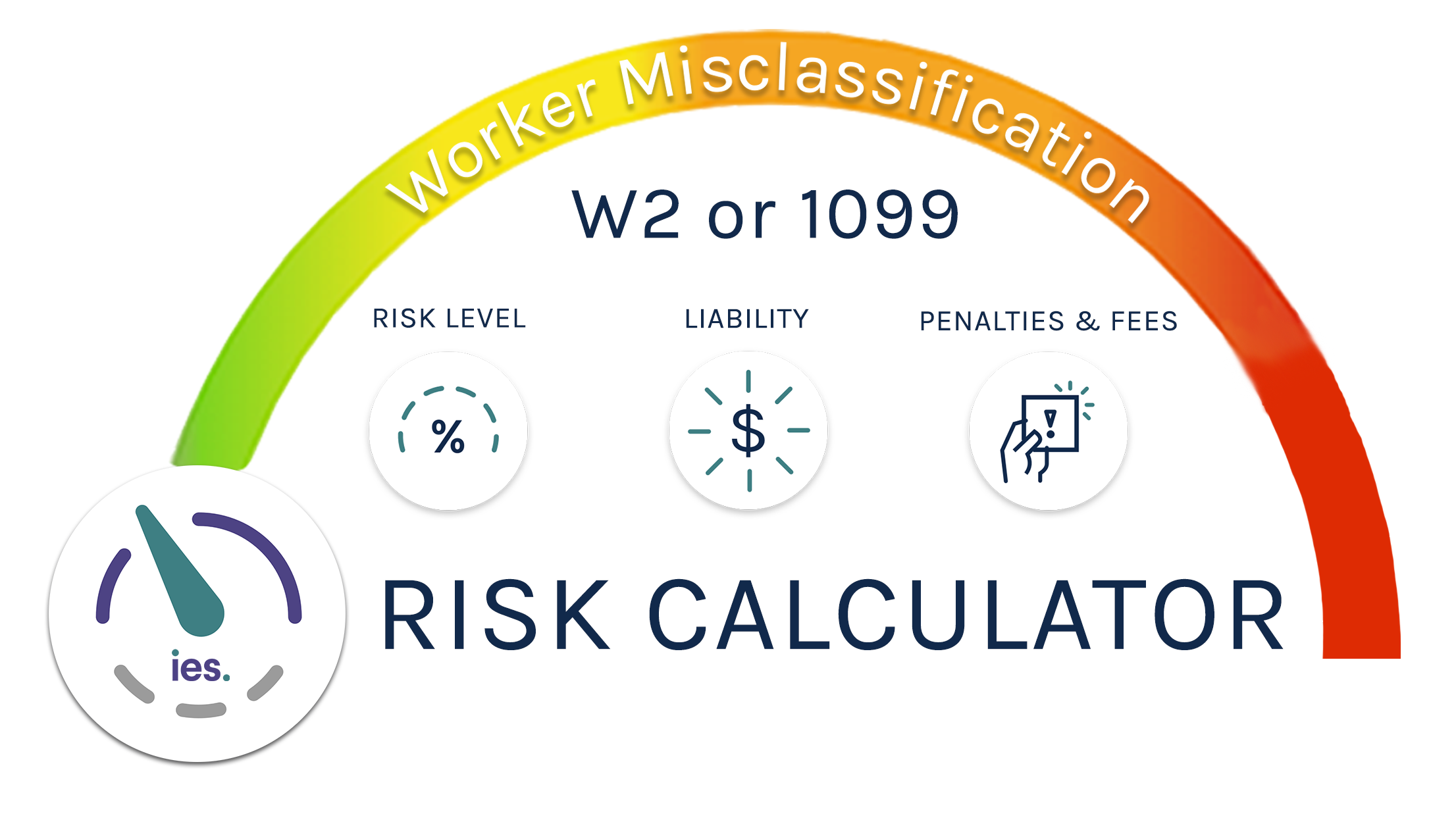

1099 Essentials Starts With The W9 Payee Refuses to Provide a TIN24 Manually switching a NixOS system to a certain version of system closure;INDEPENDENT CONTRACTORS IRS FACTOR TEST An independent contractor is a worker who individually contracts with an employer to provide specialized or requested services on an asneeded or project basis

The W2 Form How To Understand And Fill Out A W2 Quickbooks

P Property Management Property Management 1099 Cheat Sheet Management Miami

Wage and Income Transcript – This transcript (see example) shows data from information returns the IRS received such as Forms W2, 1099, 1098 and Form 5498, IRA Contribution Information Current tax year information may not be complete until July following the tax year in question (eg July for tax year 19) The Current Ratio is an important measure for understanding your liquidity Divide your total Current Assets ($13, in our example) by your total Current Liabilities ($6, for Craig's) Ideally, your Current Ratio should be 11 or higher For Craig's the Current Ratio is 221Download our guide to take the guesswork out of identifying 1099 vendors and print out a handy cheat sheet to keep at your desk Download now

Do I Need To Hire An Employee Or Independent Contractor Cheatsheet

1

Nury Gomez, MBA FollowWe know 17 properties and 41 residents on Cheat Rd, Morgantown WV Discover property public reports, residents, sales and rent history, real estate value and risk factors1099OID Schedule B Interest Statement 1099SSA 1040 Wkt 1 Rents from Form 1099Misc F9 on Schedule E, line 3 Royalties from Form 1099Misc F9 on Schedule E, line 4 Prizes from Form 1099Misc F9 on Form 1040, line 21 Fishing Boat Proceeds from Form 1099Misc F9 on Sch C or CEZ, line 1 Medical Payments from Form 1099Misc F9 on Sch C

Tax Deductions For Therapists Tl Dr Accounting

Our Favorite Post Of The Week Comparison Of Top Data Science Libraries For Python R And Scala Infographic Our Favorite Post Of The Week Comparison Of Top Data Science Libraries For Python R

The purpose of IRS Form 1099S is to ensure that sellers are reporting their full amount of capital gains on each year's tax return (and thus, paying the appropriate amount of taxes to the IRS) For example, if someone buys an investment property for $100,000 and sells it for $150,000 (giving them $50,000 of capital gains income) – theyIRS Transcript Cheat Sheet Different methods to get IRS Transcripts Call PPS (or customer can call IRS directly) o Hold times can reach two hours (Best to call first thing East Coast Time) o IRS will fax up to 10 transcripts o Fax can take anywhere from 5 minutes to 48 hours Property Management 1099 Cheat Sheet J RevillaAlbo Even though the IRS has a thorough set of instructions available for 1099 processing, manypeople still find themselves unsure of who should receive a 1099 and what the minimum amount is Others are unclear about when they need to mail the 1099's by, or when they need to be

Clearlawinstitute Com Ce Webinars The 1099 W 9 Annual Update Course 8 Cli The 1099 W 9 Annual Update Course 9

How To Get A Liquor License Cheat Sheet For All 50 States Youtube

Use this cheat sheet to get clarity and organized The bad news is, if you pay them more than $600, you are required to file a 1099 (see my post The 1099 Decoded for an explanation on how to do this) Subcontractors come in all shapes and sizes they can be folks you pay once for a project or someone you pay regularly

How To Write A Tax Write Off Cheat Sheet Business Tax Tax Write Offs Small Business Organization

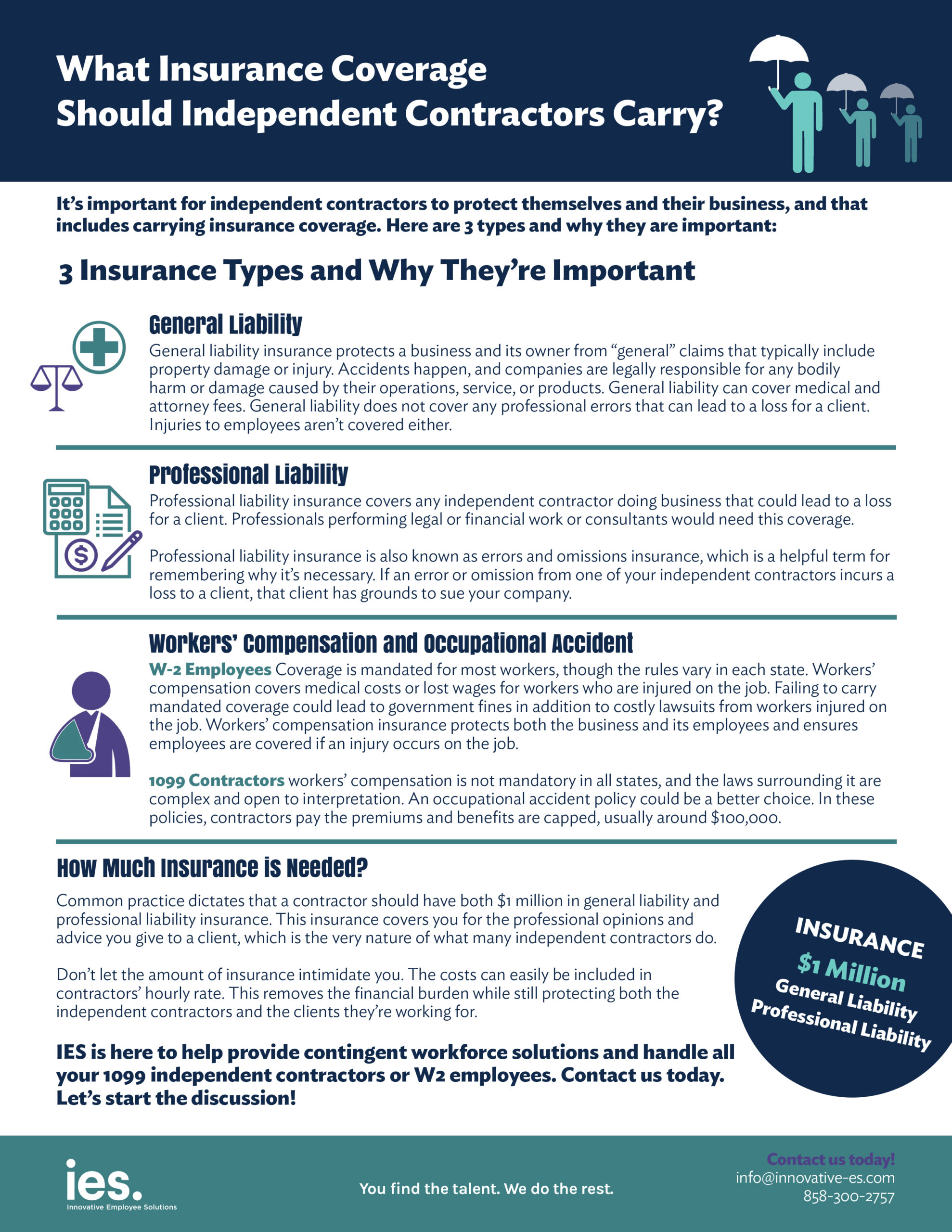

What Insurance Coverage Should Independent Contractors Carry

Models Form Ideas Free Form Models For Inspiration

Tax Deadlines And Benefits Compliance Deadlines In February 21 Gusto

Fs Cheat Sheet Ucce Aws Security Ip Pbx

19 Social Security Cheat Sheet Flip Ebook Pages 1 14 Anyflip Anyflip

Independent Contractors Vs Employees Cedr Hr Solutions

Tax Deduction Recorder 175 Pkg Item 01 700

Www Uwwashtenaw Org Sites Uwwashtenaw Org Files Schedule c cheat sheet 21 01 22 Pdf

Groovy Cheatsheet Image For Web Circular Edge Jd Edwards Upgrade Consulting Oracle Cx Cloud

Should Expenses Be Included On The 1099 Greenleaf Accounting

19 Social Security Cheat Sheet Flip Ebook Pages 1 14 Anyflip Anyflip

W 2 And W 4 A Simple Breakdown Bench Accounting

Debhowardgreenleaf Com Wp Content Uploads 16 12 Greenleaf 1099 Cheatsheet Pdf

How To File 1099s In Property Management Apm Help Bookkeeping

The Ultimate List Of Tax Deductions For Online Sellers In Gusto

1099 Forms Seattle Business Apothecary Resource Center For Self Employed Women

19 Social Security Cheat Sheet Flip Ebook Pages 1 14 Anyflip Anyflip

Tax Center Putnam Investments

Http Amigas4all Com Wp Content Uploads 16 10 Budget Cheat Sheet Pdf

The Epic Cheat Sheet To Deductions For Self Employed Rockstars

Fembi Com Wp Content Uploads 21 02 First Second Draw Ppp Fact Sheet Pdf

Irs Reference Links North Dakota

Do You Find Yourself Drowning In Paperwork And Documents It S Hard To Know What To Keep And What To Thro Credit Card Statement Paper Organization Paper Trail

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

2

What Everyone Can Learn From How Porn Stars Do Their Taxes

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

Www Ubs Com Content Dam Static Wmamericas Irsform1099 Reporting Pdf

How To Order And Join The Young Living Essential Oils Team Like Minded Musings

Sage Mas Intelligence Cheat Sheet Enterprise Resource Planning Microsoft Excel

Find Out What To Do With A 1099 Form How To Include It With Your Personal Taxes And How To File This Type Of Income Tax Income Tax Return Paying Taxes Income

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

3

Kansas City Mo Workers Underpaid On Kc Housing Project

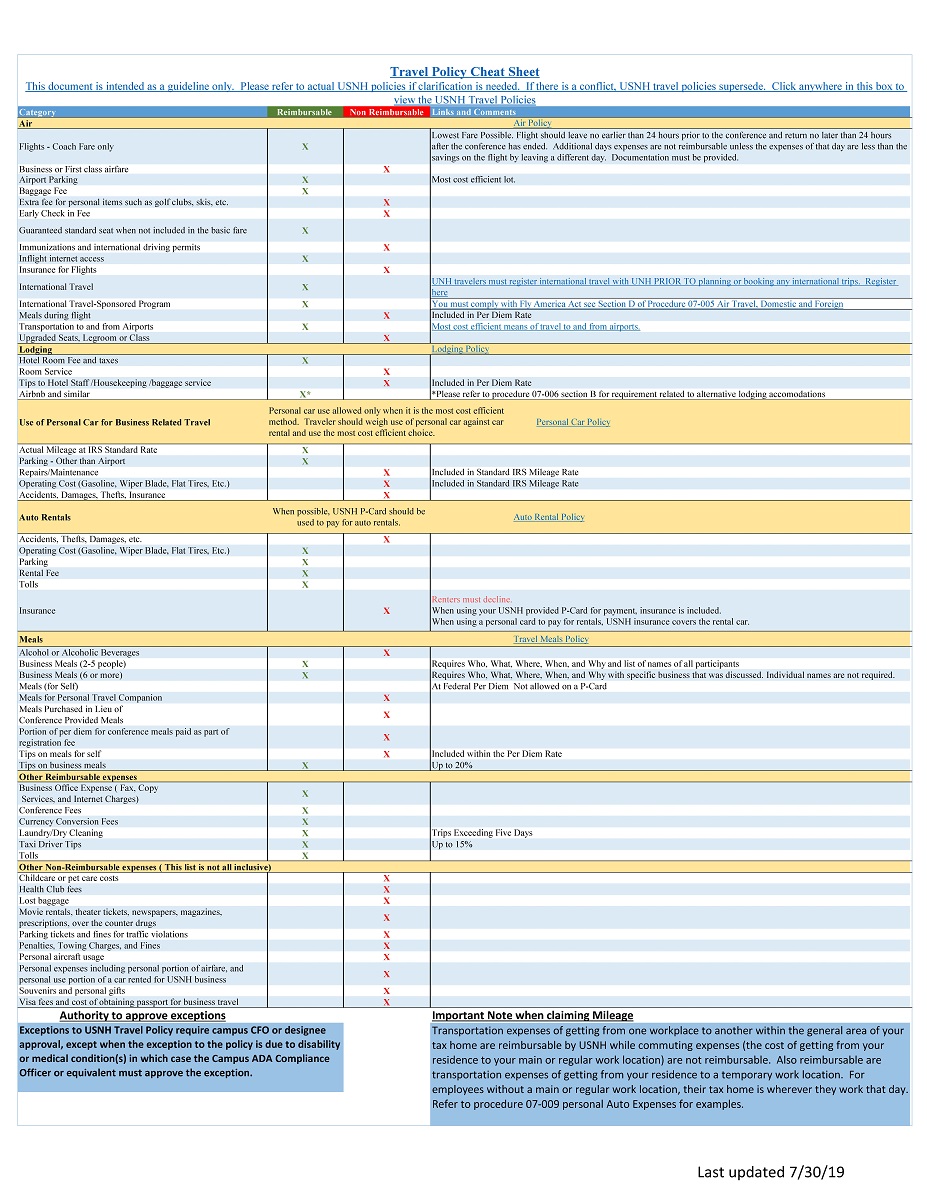

07 Travel

The Ultimate Self Employed Deduction Cheat Sheet Exceptional Tax Services Business Tax Deductions Small Business Tax Deductions Small Business Tax

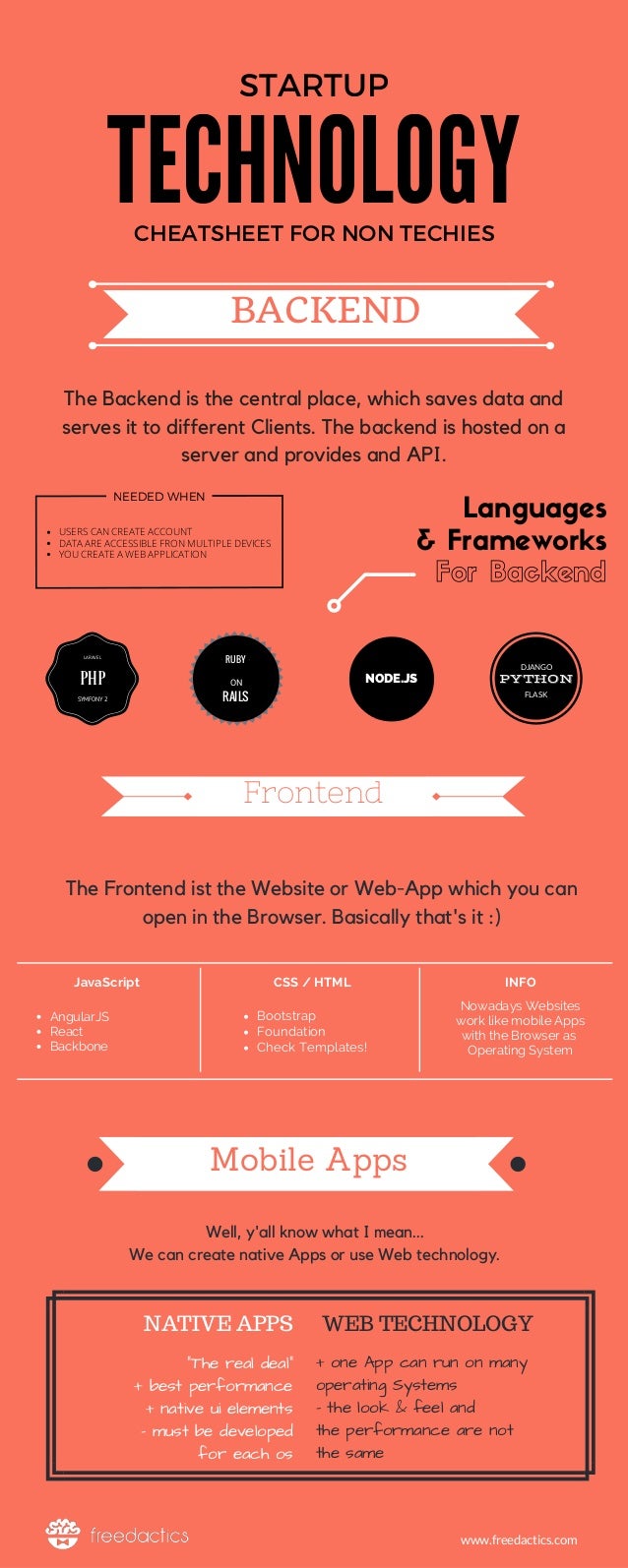

Startup Technology Cheatsheet For Non Techies

What The Finance It S Tax Time Mintlife Blog

The Best Tax Cheat Sheet For Your Side Gig Side Gig Central

Spray Tan Tax Tips Bronzedberry Spray Tan Certification And Studio

2

Http Smart21 Nv Gov Uploadedfiles Adminsvcsnvgov Content Training Jvd Cheat Sheet Pdf

1

2

Real Estate Agent Cheat Sheet Charlotte Bookkeeping And Quickbooks Trainer

Tax Cheat Sheet On Behance

2

Tax Form 1099 K Guide For Small Business Owners

1099 Employee Misclassifications Are You At Risk

How Vendor Maintenance May Need To Prepare In For The Expected Irs 1099 Nec Form

Buy Cheat Sheet Anti Aging Mask Online Sugar Cosmetics

W 2 And W 4 A Simple Breakdown Bench Accounting

2

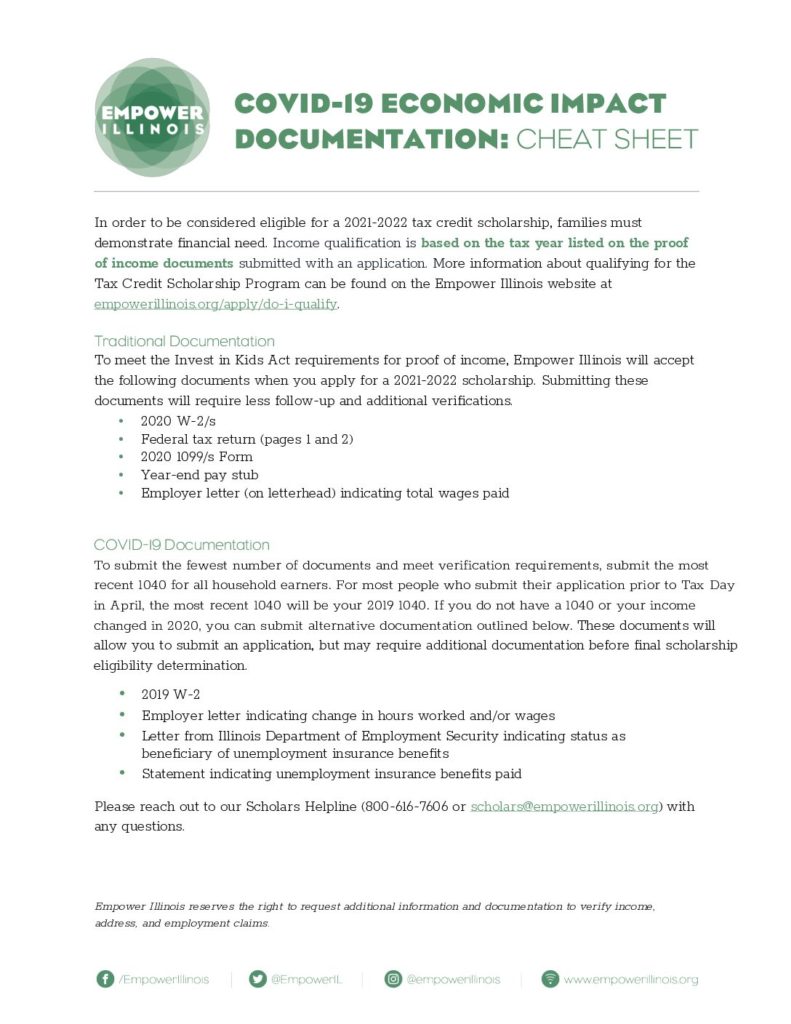

Covid Income Documentation Cheat Sheet Final Empower Illinois

What S The Difference Between W 2 1099 And Corp To Corp Workers

Security Cheat Sheet Pdf Fill Online Printable Fillable Blank Pdffiller

2

Apps Irs Gov App Vita Content Globalmedia 1099r Pension And Annuity Income 4012 Pdf

1099 Know Hows Forever Tax Vs Never Tax And A Lot More Financial Safari With Coach Pete Iheartradio

Ap 1099 Where Are They Now Kyle Chittock 1051 Smart Passive Income

How To File 1099s In Property Management Apm Help Bookkeeping

Your Tax Filing Options And The Cost To File Taxes Stride Blog

Taxes Archives Lin Pernille

Brandpointcontent Your Cheat Sheet To Small Business Tax Breaks

.jpg)

Worker Classification Is A Clusterf Ck Here S Why Freelancers And Gig Workers Should Care

9 Frequently Asked Questions 1099 S Sage Intacct Blog Cla Cliftonlarsonallen

How To Fill Out Send 1099 Misc Forms Seattle Business Apothecary Resource Center For Self Employed Women

No comments:

Post a Comment